Creating a Banno Mobile account

Users can create a Banno Mobile account whether they have an online banking account or not.

- Open Banno Mobile.

- Select First time user? Enroll now.

-

Choose a situation and follow the corresponding step.

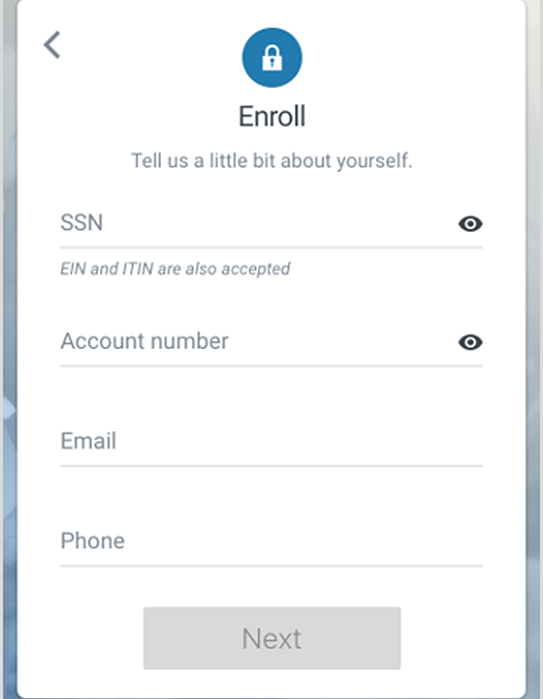

Situation Step The user has an online banking account. Continue to the next step. The user does not have an online banking account. Create a profile by entering an SSN, EIN, or ITIN, in addition to an account or member number, phone number, and email address. Enrollment screen for users without an existing online banking account

-

Choose a situation and follow the corresponding steps.

Situation Steps Your institution uses multifactor authentication security questions (MFA) to authenticate users. Answer the security question presented, or create new ones if there are no existing questions.

Your institution uses 2-step verification. - When the Protect your account with 2-step verification screen appears, select Get started.

- Choose from Voice or text message, Email, Authy, or Authenticator app.

- Follow the instructions for the chosen method.

- Select Done.

For institutions who went live with Banno after September 15, 2021, their end users who are new or who have removed all their two-step verification methods are asked to validate a one-time password. The one-time password is sent to the email address stored in their profile from your institution's core or from the Cash Management profile. Institutions who went live with Banno before September 15, 2021 can choose to enable this feature in Banno People.

- When the User Agreement screen appears, consent to the e-signature agreement and then select Accept.

-

Choose a situation and follow the corresponding steps.

Situation Steps The user is logging on using an existing online banking account. Continue to the next step. The user is creating an online banking/mobile banking account. - Create credentials by entering information in the Username and Password fields.

- Select Next.

The end user can see username and password rules by selecting Show rules for either.

If your institution is a bank, whether using NetTeller or Banno Mobile, Banno uses the same NetTeller password and alias requirements.

If your institution is a credit union using Symitar, Banno uses the Symitar home banking username and password requirements as defined by the credit union. In addition, the Symitar database requires that the username must begin with a letter and cannot contain special characters.

CAUTION:Banno does not enforce its own separate password rules, but it does prevent the use of account numbers as usernames for security reasons. -

Create a passcode, and then confirm it by entering it again on the following

screen.

When the end user logs on to the app, they can enter the wrong passcode five times before the app removes all data from the device and requires them to reauthenticate.

- Enrollment

Users who do not have existing online banking accounts can enroll in mobile banking through Banno Mobile. - Account recovery

If a user forgets their user name or password, they can recover it by selecting Forgot?.