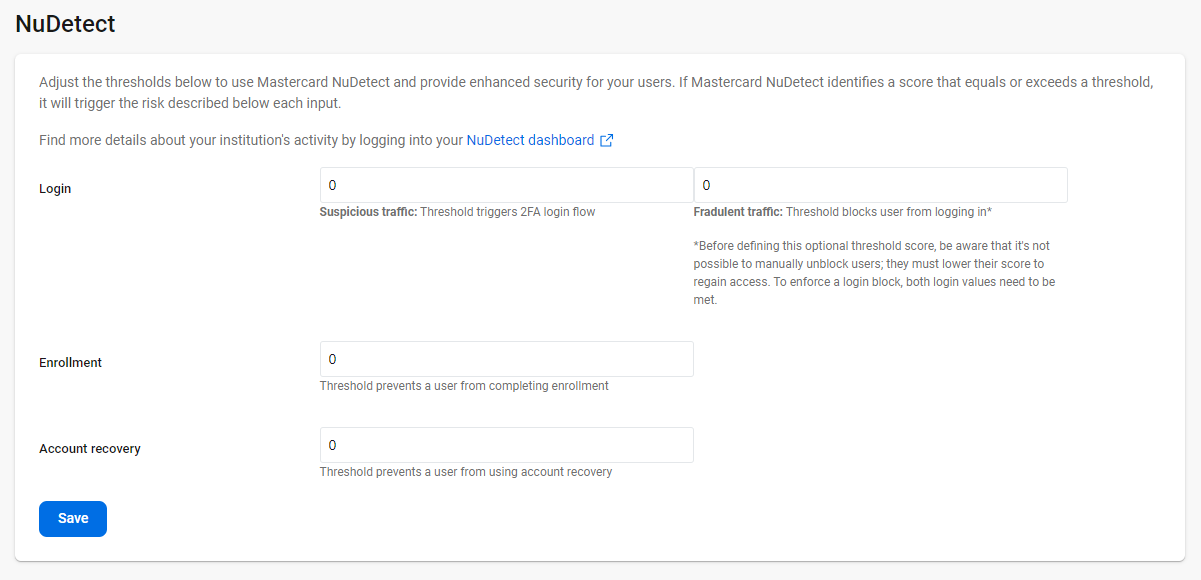

NuDetect

Using Banno People, you can set up your NuDetect score configuration.

To configure your institution's NuDetect scores, visit .

NuDetect helps your institution tell the difference between an authorized end user and a fraudster during the login, enrollment, and recovery processes. The numeric score returned by Mastercard® NuDetect indicates the level of risk. Scores that are equal to or above the configured threshold trigger a risk event that is different depending on the location.

Here are the fields that you can configure on the NuDetect screen:

- Suspicious traffic

-

In the Login section, enter a number in the Suspicious traffic field, and any score equal to or above this number requires the end user to input 2-step verification.

Mastercard® recommends setting a score at or less than 200, but some financial institutions start with a slightly higher score and can adjust the score if needed.

- Fraudulent traffic

-

In the Login section, enter a number in the Fraudulent traffic field, and any score equal to or above this number prevents the user from logging in to Banno Apps. Set this score higher than the Suspicious traffic score and high enough that only obvious fraudulent activity is blocked.

If a login is blocked for fraudulent activity, Banno displays an error message that states We couldn't find you. Please check the information that you provided and try again. The user can select Call now or OK.

If a legitimate end user is blocked, there's no way to unblock the individual because self-serve account recovery and manually resetting enrollment are unavailable. Instead, the user must work with your institution to understand why they have a high NuDetect score so that they can take measures to lower their score.

- Enrollment

-

Enter a number in this field, and any score equal to or above this number prevents the end user from proceeding to enroll. When enrollment fails, Banno displays a 403 error to the end user that states Oops! Something went wrong on our end. Please try again.

Mastercard® recommends setting a score at or less than 500, but some financial institutions start with a slightly higher score and can adjust the score if needed.

- Recovery

-

Enter a number in this field, and any score equal to or above that number prevents the end user from recovering an account. When account recovery fails, Banno displays a 403 error to the end user that states We couldn't find that for you. Please check the information that you provided and try again. If you haven't enrolled yet, try that instead.

Mastercard® recommends setting a score at or less than 500, but some financial institutions start with a slightly higher score and can adjust the score if needed..