June 2024

Banno Business™ updates • Treasury Management updates • New JH Resource Center goodies • Plus more

Summer is in full swing, and so is your team of partners at Jack Henry[...]

June 2024

Many years ago, I saw the remake of “Dawn of the Dead” and was forever changed by it. I began to evaluate my life through the lens of surviving a Zombie Apocalypse (ZA). What would I do if zombies walked the earth?

There are plenty of skills needed to make it through the ZA. Farming, medical training, zombie trap-making... the planning can be daunting. Lots of decisions to make on what supplies you carry with you, what companions give you the best chance of survival.

You know what’s really critical, though? A safe place — somewhere that you can take stock of supplies and determine your next move. Maybe have some beef jerky and one of those mini Snickers bars that you scavenged from the gas station.

In much the same way, having a safe and reliable place to manage your finances is crucial in today’s world. Those of us in Jack Henry Digital are committed to helping you provide that digital safe place for your members/customers. Your relationship with them has never been more important, and we plan to keep building so that you can focus on helping them plan for the future. Check out our passkey updates and then make sure to stock up on the complimentary marketing collateral.

On behalf of Jack Henry’s partnership with Mastercard NuDetect, we’re excited to share with you that NuDetect will be rolling out a new and improved dashboard, which your staff can access in Banno People, starting later this month!

To learn about what’s coming and get a sneak peek of what the new Dashboard will look like, we encourage all NuDetect customers to register and join us for our next Mastercard + Banno Monthly Orientation on Friday, July 12 at 1:00 p.m. CT.

Not yet contracted for NuDetect? Interested in learning more about this fraud prevention feature? Drop our sales team a line at digitalexperience@jackhenry.com

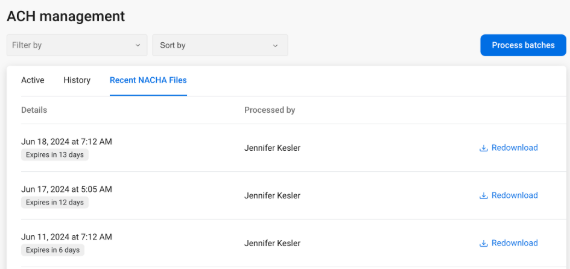

Attention credit union customers who use ACH in Banno Business! You will now be able to access NACHA files that have been generated out of Banno People. And better yet, no support case is needed to get this configured.

The newly added Recent NACHA Files tab will show files from the past 14 calendar days, along with key details about who finalized the file and when (in your core time zone for easy reference). We’ve also updated the filename for the NACHA file to include the date, time, and file modifier, so that you can match what you see on the screen to the file that you’ve downloaded.

The wait is over! The complimentary Banno Business marketing campaigns are now available for you to customize on the Jack Henry™ Resource Center. These campaigns were crafted to help you quickly and easily drive adoption and usage by highlighting the benefits and features that solve the business banking needs of your accountholders.

The good news doesn't end there! We also have a wealth of Treasury Management (TM) resources available via the Resource Center too. This includes new collateral for the TM Mobile Experience as well as Unified Identity Service. These resources are designed to support your business banking efforts and provide you with even more tools to strategically enhance your services and meet your accountholders' needs effectively.

Have questions about the Resource Center, or need help getting started? Contact the Resource Support Team at resourcecentersupport@jackhenry.com.

We're thrilled to announce the first-ever Jack Henry Developer Conference, happening at the Will Rogers Memorial Auditorium in Fort Worth, Texas on Wednesday, November 20.

Event registration will open up soon, and tickets will be available for purchase.

We hope to see you there!

Who’s ready to get automated?! The Treasury Management integration with Enterprise Workflow is getting ready to roll right into beta. We hope you're as excited as we are! Using Enterprise Workflow is a game-changer, cutting down the steps to onboard a business from a tedious 300 clicks to an incredible 3 clicks! Say goodbye to hassle and hello to efficiency in Treasury Management Back Office! Be on the lookout for some goodies to be posted soon!

We are happy to share with you that device de-authorization has been added to our list of high-risk actions. Why? Because it’s one of the first things a fraudster does after hacking an account to lock out the real users. To stop this, we’re rolling out the ‘Block HRAs on New Devices’ project. This means any sketchy attempts to deauthorize devices will be blocked right away, keeping your account safe.

Today, this is only in place for Online and will be in place with iOS 3.14 app version with Android shortly following.

Here are a few things to remember this month.

As mentioned in an SLA earlier this month, we announced the availability of a new security feature designed to help fraud prevention. This feature allows credit unions to block external transfer requests while in memo mode, effectively preventing fraudulent transactions. Enabling this feature may also avoid extra work for your team to review and delete duplicate transfers before ACH processing.

Just hop over to Banno People to enable the new feature: Click the Settings dropdown, click Transfers, select the Block memo mode transfers checkbox, and save your changes! We also added these instructions to our External transfers FAQ documentation on the Knowledge Base, should you need a refresher down the road.

Banno Business for Banks now supports Bill Pay enrollment. Your business customers can now quickly enroll in Business Bill Pay via Banno. For details on how business users can enroll, visit the Knowledge Base: Enrolling in payments with iPay

Save your seat now for these upcoming events:

Some folks have asked us, “Can I build a plugin that uses non-Jack Henry APIs?”

The answer is a resounding yes.

If you’ve seen our Simple Plugin Example, then you’ve seen how to build a plugin that uses Jack Henry’s APIs. Likewise, we’ve created the Basic Plugin Example as a way to demonstrate that you can, in fact, build a plugin which uses non-Jack Henry APIs.

We also have a companion tutorial, How to Create a Banno Plugin (Basic), to help you learn the concepts.

Earlier this month, we added a new passkeys section to the Security tab on the user profile in Banno People, so your authorized staff can view and remove an individual's registered passkeys. This feature is part of our ongoing commitment to providing your end users a secure digital banking environment.

Why is this important? Whenever fraud occurs on a profile, it’s crucial to take immediate action to protect sensitive information and prevent further unauthorized access. As you may know, it’s best practice for your customers to remove devices; however, it’s also important to remove registered passkeys.

Need a refresher on what a passkey is? Spend a few minutes getting reacquainted with our documentation on the Knowledge Base.

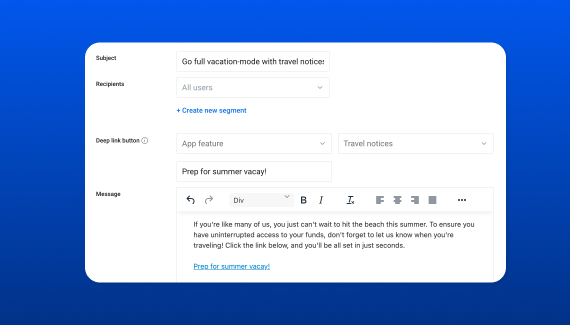

As a follow-up to the Segmented Messages feature we delivered to everyone earlier this year, we will soon support the placement of deep links into Messages sent from Banno People. These links will help you direct users to the in-app feature or single sign on of your choice, letting your team convert those messages into actionable opportunities that motivate end users and drive adoption.

Make sure to keep your eyes peeled as we’ll be providing links to documentation and timing details soon!

Frustrated by having to ‘back up’ when onboarding new users and associating companies in the Treasury Management Back Office? Let those frustrations fade! You’ll soon see two new options when performing these functions: Submit and Add Another (users) and Save and Associate Another (companies). These small changes will save clicks and improve the workflow for your Back Office users.

Back Office is first, but these handy buttons will also be available for Channel in a future release. Stay tuned!

As announced on June 4, the new Mobile Experience (formerly PWA) for Treasury Management will be available on July 1! What a way to kick off summer, right?!

As a reminder, you no longer need to wait for Unified Identity Service (UIS) to move forward with the Mobile Experience. Additionally, the deadline to migrate to the Mobile Experience has been extended to February 28, 2025.

Did we mention we’ve got all kinds of helpful information available to assist you with planning your migration? You can find all of our Mobile Experience goodies on the Treasury Management Knowledge Base page under the Mobile section. Make sure you don't miss our new Mobile Experience Overview video while you're there!

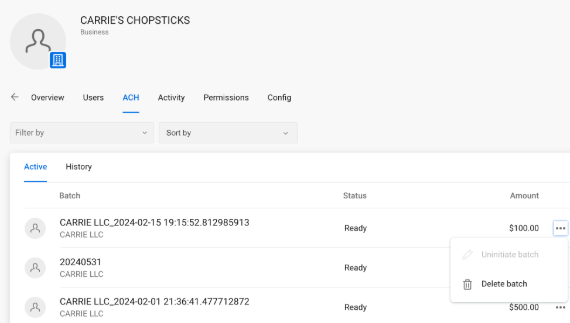

Credit unions using Business ACH can now grant their employees permissions to uninitiate or delete batches from the organization page. To uninitiate or delete batches, staff members who are authorized with the necessary permissions can open the organization’s page in People, select the ACH tab, select the ellipses icon (•••) for any active batch, and then click Uninitiate batch or Delete batch.

We understand that our credit union customers highly value the automation offered by EASE. That's why we're developing a solution to automatically transmit the NACHA file generated for Banno Business to EASE for processing. You'll still have the option to download the file manually if needed, but we are thrilled to announce that soon we will provide a seamless One Jack Henry approach for credit unions!

We’re excited to share that we’ve added a Digital Banking Meetup: Add-ons Special to the calendar in July for you— a double dose of digital! On Wednesday, July 24 from 9:00-10:30 a.m. CT, join our Digital Product team to learn more about our add-on solutions and how they can help you enhance the digital banking experience for your accountholders.

This session gives you the chance to see some of our add-on solutions demoed, interact with our Digital Product team, and ask questions. You won’t want to miss out!

Check out our latest and greatest documentation on the Knowledge Base:

If you have questions about anything you have read here, please contact Support.

Release notes are posted in the For Clients portal in advance of mobile releases and contain a rollup of all client-side changes made to Banno within the period.

Want to stay in the know about the latest features and enhancements we’re making to the Jack Henry Digital Banking Platform? Subscribe below and you’ll receive an email straight to your inbox every month when the Digital Banking Statement hits the press!

SubscribeSummer is in full swing, and so is your team of partners at Jack Henry[...]

Time to soak up some sun, right after you soak up the latest from Jack Henry Digital! [...]

As the blossoms of spring start to bloom, so do the innovative features and enhancements we're excited to unveil. We hope this update finds you in high spirits and ready to dive into [...]

Spring is in bloom and we're excited to share iwth you what we've been growing [...]

We've been grinding especially hard with our Google Cloud Platform (GCP) migration prep, all the while keeping our product roadmaps moving [...]

We're excited to share what the Digital team has been up to this January. We hit the ground running, and there's more to come in the year ahead! [...]

On behalf of the Jack Henry digital team, we wish you [...]

As we pause to give thanks, all of us at Jack Henry want to express our appreciation for your [...]

Fall is in the air, and so is our latest suite of product announcements! [...]

Life (and fintech) is like a pillowcase full of candy. We’re thrilled we get to help your team realize your strategic [...]

Let’s talk about what this could look like for your institution.