October 2023

Skip-a-Pay PowerOn update, high-risk prompt for NuDetect, Segmented messages, Treasury enhancements, Banno Business updates • Plus more

Fall is in the air, and so is our latest suite of product announcements! [...]

November 2023

As we pause to say thanks, all of us at Jack Henry want to express our appreciation for your continued trust and partnership. We are truly grateful for the opportunity to serve you and look forward to shared success in the future.

SilverLake customers, spread the word! Your business users can initiate single domestic wires on their mobile device! Additionally, they can use your mobile apps to view all active and historical wires—complete with transfer details—for their business.

There's no support ticket needed for this feature; if the Wires ability has been enabled for your financial institution, business users with Wires permissions should have access on Mobile now as well.

For our business banking customers who offer Positive Pay on the Banno Digital Platform™, we appreciate how patient you’ve been. We are happy to share that come next month, when you view check exception details in People, you’ll see any images provided for each of those checks. When available, thumbnail images of the front and back of the check will be displayed on the details screen. Better still, you can even click into the images for a zoomed-in view and/or print them for your records.

No need to submit a support case for this one, as the feature doesn't require additional configuration.

We’re thrilled to introduce some fantastic new ACH management features, which are currently slated to ship with Banno Mobile version 3.9 for both iOS and Android:

These new features will empower you to manage your ACH transactions with greater flexibility and efficiency—all on your Android or iOS device!

No need to submit a support ticket, either. If your financial institution has ACH enabled, business users with the ACH permission will see these new features on Mobile as they're released.

The updated Jack Henry (JH) terms we've described in the last couple of Statements are now available on the Knowledge Base (JH Digital Banking Terms of Use), so you can determine whether to add any custom terms that are specific to your financial institution.

Since it took longer than anticipated to make the new JH terms available, we are extending the review period until December 15, at which point the switch to the new system and new default JH terms will take effect.

Other than pushing back the switchover date, the rollout plan and what you can expect has not changed since last month.

Once you accept the default terms or save your custom terms in People, end users will be prompted to accept the new EULA as they log in. If you do add custom terms, end users will see them included above the default JH terms, and they will accept all the terms at once (rather than accepting two sets of terms presented separately).

If you decide not to add custom terms before the December 15 switchover date, the new system and default JH terms will take effect on December 15 (whether or not you have accepted the JH default EULA in People), and any custom terms you had provided previously will not be included.

We’re excited to announce that the new Zelle Ready Contacts feature, which will let end users quickly identify any other Zelle users listed in their contacts, will be released (and enabled by default) in early December for all customers who offer Zelle.

Transactions to and/or from these contacts will be faster and will give your users greater confidence that they're sending money to the right person. On Mobile, end users will also have the option to sync their device contacts, so they can skip the manual process for adding new Zelle recipients and skip straight to sending money—just in time for any last-minute gifts this holiday season! Are you Zelle-ous?!

The Loan Payoff PowerOn is a helpful feature when members want to self-serve in determining their payoff amount for a specified date. This PowerOn also lets your members view a disclosure regarding the payoff amount.

Even if your credit union already leverages the Loan Payoff PowerOn, you may still want to implement these changes by upgrading to the latest version:

If you are interested in installing or upgrading the Loan Payoff PowerOn, please submit a case via the For Clients portal. Need to check your Loan Payoff PowerOn version? Just follow these steps.

Here are a couple things to remember this November and December.

Don’t forget to make any necessary updates to your Processing Cut-off Times for ACH, Wires, Exceptions, etc. for the upcoming holidays.

From the TM Back Office, select Configuration > Processing Configuration > Processing Times to make updates. You can remove an entire date from the processing calendar by using the Holiday Exceptions feature. On the Processing Configuration page, select Holiday Exceptions from the menu on the left. Adding an exception disables the date for end-user selection for all payment types.

Better reserve your spots now for these upcoming events:

We have so many resources for developers that we know it can sometimes be difficult to find what you are seeking within all the publicly available documentation.

We’ve heard your feedback, and we’ve added the ability to search the developer docs. You can try it out now: JackHenry.Dev

We’re finalizing details about how you can add a background image to your bank’s Treasury Management login screen—yay! Get those creative juices flowing to come up with an image that speaks to your brand. Specifics will be provided on For Clients when the ‘how-to’ process is solidified. Stay tuned for more details in a Statement headed your way!

We’re continuing to add ways to create a business batch by introducing Copy Batch. Organization users can select an existing active batch and make a copy of the batch (details and recipients for later use). We’ll also provide an option for the user to zero out the amounts of the recipient payments in the batch so they can be freshly entered for the next use.

Stay tuned for more details and user instructions, which we'll share once we're ready to release this feature.

How often do you encounter batches that have been initiated but require correction? Chances are, the answer is a lot. We think this presents an opportunity to save your business users valuable time, so we are happy to announce that rather than deleting a batch and starting from scratch, they can now unitiate a batch, edit the details, and reinitiate it.

Additionally, now your authorized employees who are performing processing tasks in People can uninitiate a batch and return it back to the business for correction and reinitiation.

There's a new ACH tab on the Business profile screen in People, which your support staff can use today to view active and historical ACH batches for an organization.

The current view-only state for the ACH tab marks the first of two features for this project, and we’re already hard at work on the second deliverable! Up next? We're building permissioning so authorized support members can Uninitiate and Delete ACH batches from that same ACH tab on the organization profile screen.

When creating a new business administrator, have you ever found yourself concerned that the person who completes enrollment may not be the person you intended? We’ve been concerned about this too. So we’re creating a new optional configuration that will require the first administrator of a business to verify their identity using known contact information prior to completing the enrollment process.

For now this configuration will only apply to the first administrator, but we’re investigating adding additional options for all users. Keep an eye out in our upcoming Statements and we’ll let you know when it's ready for use.

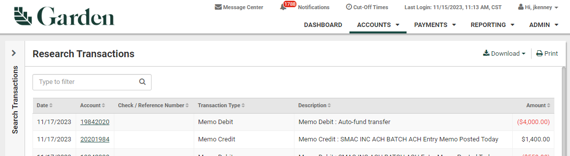

A new Type-to-Filter enhancement for the Account Transaction and Research Transaction pages was released the week of November 6. Don’t forget your customers can now drill down and find specific transactions much more quickly!

Fraud is everywhere these days, and we know it is top of mind for all our customers. It’s top of mind for Jack Henry, too! We’re always looking for ways to help mitigate the volume of fraudulent activity and identify it before it even occurs. To that end, we're implementing some new EES alerts that third-party tools can hook into to help identify and take action during the key moments when fraud is most likely to occur.

Internally, we call these critical moments high-risk actions. Some examples of high-risk actions end users can take include moving money or adding new payment recipients, creating new accounts, and connecting third-party accounts.

We know many of you will be eager to get started with these new EES events, so keep an eye out for our follow-up announcement in an upcoming Statement when these events are live.

Catch up on our most-recent Knowledge Base additions:

If you have questions about anything you have read here, please contact Support.

Release notes are posted in the For Clients portal in advance of mobile releases and contain a rollup of all client-side changes made to Banno within the period.

Want to stay in the know about the latest features and enhancements we’re making to the Jack Henry Digital Banking Platform? Subscribe below and you’ll receive an email straight to your inbox every month when the Digital Banking Statement hits the press!

SubscribeFall is in the air, and so is our latest suite of product announcements! [...]

On behalf of the Jack Henry digital team, we wish you [...]

Let's talk about what this could look like for your financial institution.