Treasury Management

simplify banking for large, complex businesses

Empower your financial institution to compete – and win – in the commercial banking game with JHA Treasury ManagementTM, a platform designed specifically with your biggest business users in mind. Provide all the tools they need to manage their daily financial workflows and rest easy knowing they’re just as powerful and efficient as those offered by the big guys.

Welcome to the Big Leagues

a comprehensive solution for commercial banking

Treasury Management is a stand-alone, revenue generating tool built to attract, serve, and maintain relationships with your largest business users. If your corporate banking users process high volumes of transactions, need visibility over many accounts, require access for multiple users with varying roles and permissions, or need advanced payment tools and additional approval layers, they'll feel right at home on our Treasury platform.

Banno Business

needing a just-right solution for your small businesses?

If you're looking for something in between a retail account and a full Treasury Management suite, Banno Business offers just the features a small-to-medium sized business needs.

Must-Have Features

the perfect suite of cash management tools

As a company grows, overseeing its finances becomes more and more complicated. Treasury Management makes it simple for the whole team to accomplish their daily banking and money movement tasks – plus manage their company’s long term financial position – by centralizing their entire workflow.

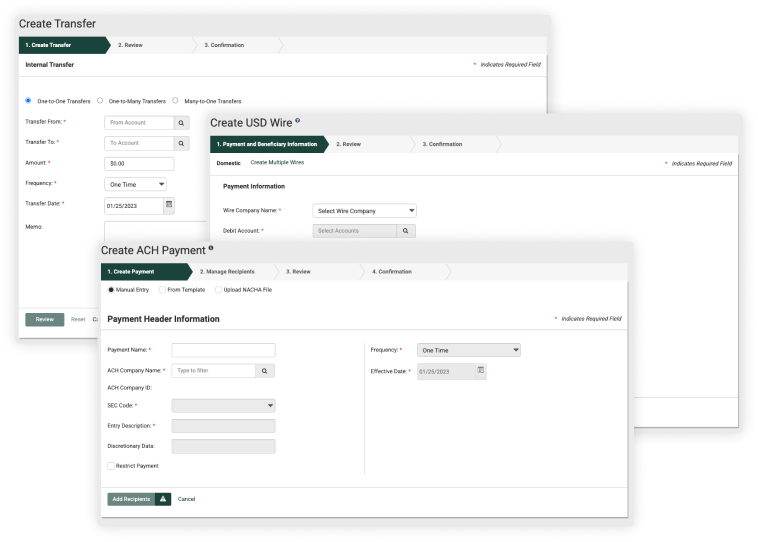

Payment Processing

Moving money is the heart and soul of business operations. Whether you're paying a trade partner, reviewing collections, or depositing checks, Treasury Management has all the features your business users need to complete their financial operations. Payments – including ACH, wire transfers, and more – are all covered with efficient, workflow-driven processes, and recipients and payment templates can even be saved and used again and again.

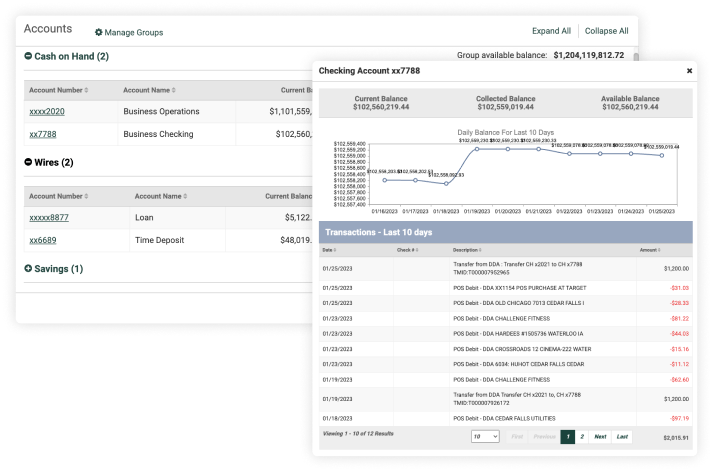

Account & Transaction Management

Businesses often have to oversee many different accounts. Treasury Management brings all of them into one location, making it simple to get a full financial picture. Dig in to transaction activity through extensive search and filtering capabilities, and quickly transfer funds between accounts one-to-one, one-to-many, or many-to-one.

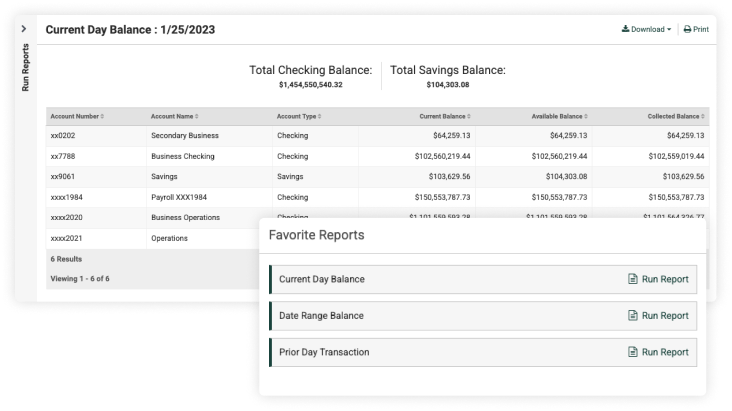

Reporting

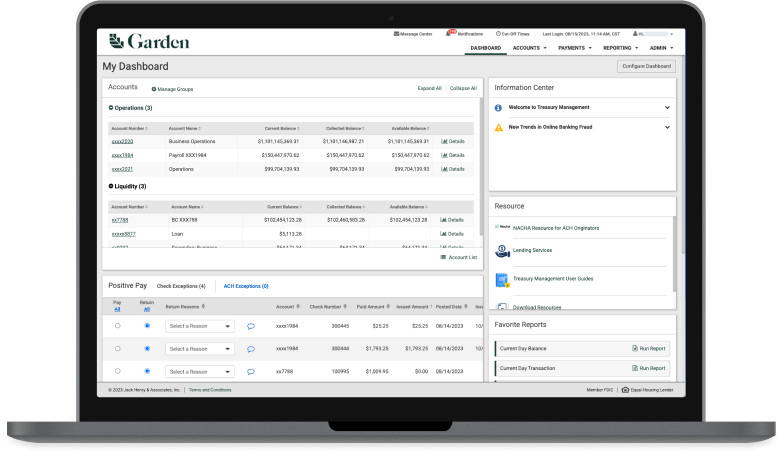

Keeping an eye on money movement at a high level is key to business success. Treasury Management gives users easy access to a catalog of reports with hundreds of custom combinations – everything from daily transaction reports to custom date-range balance reviews. Favorite reports can be saved on their dashboard for quick access, and exporting reports to share with the team has never been easier.

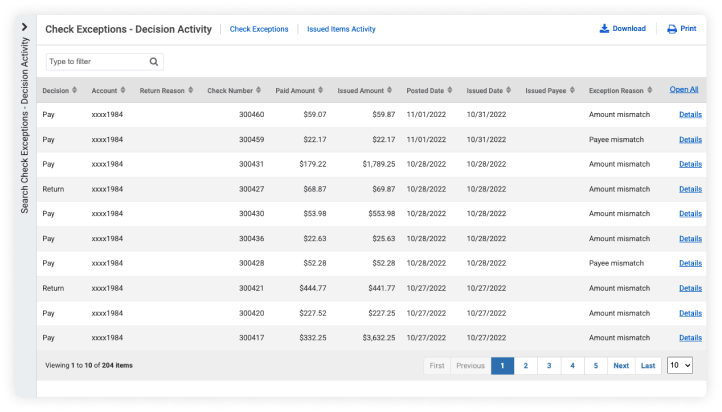

Security & Fraud Mitigation

Shield your users with a set of comprehensive fraud mitigation tools, including positive pay, account reconciliation, extensive approvals, 2FA, and security alerts. In case users need to go back and review previous activity, the platform also keeps a clear audit trail, saving date and time stamps to easily identify transactions.

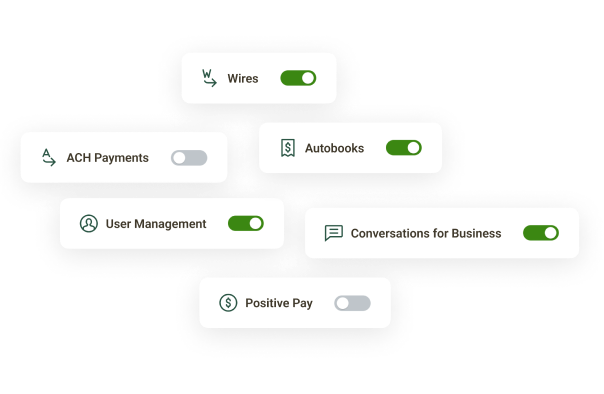

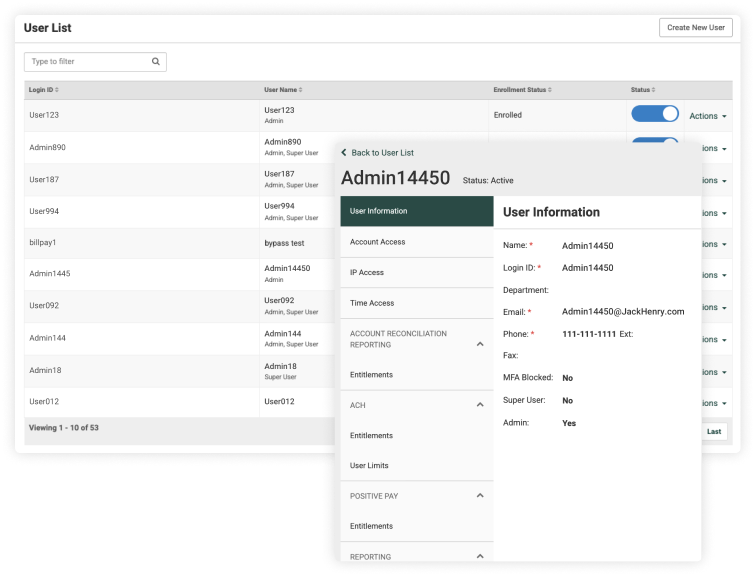

User Management

Depending on a company's needs, Treasury Management can be optimized for peak performance – both at an organizational level and an individual user level. Easily create new users, clone or edit existing ones, and provide different configurations, permissions, and entitlements for each unique role.

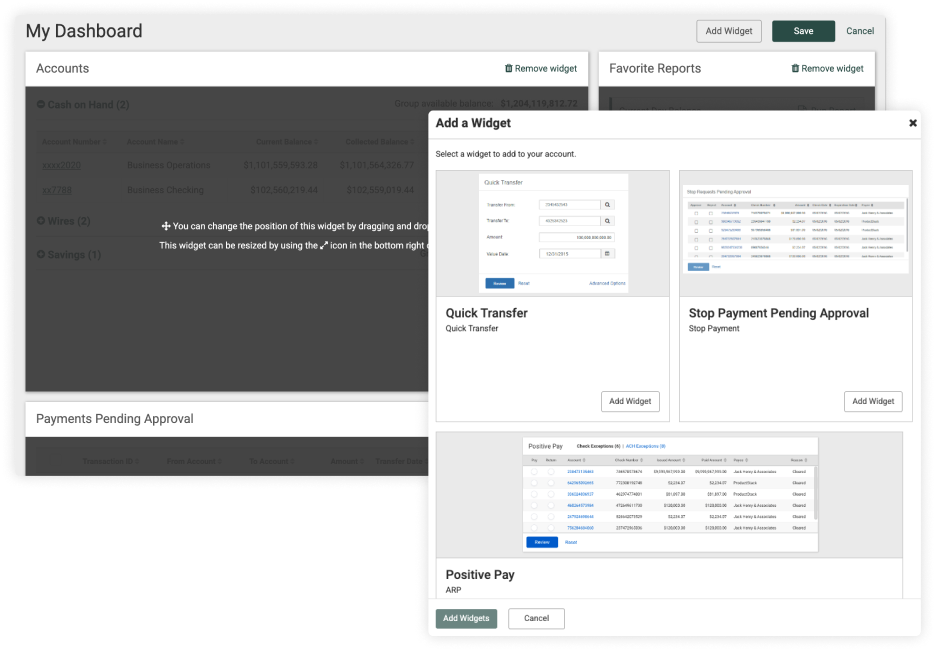

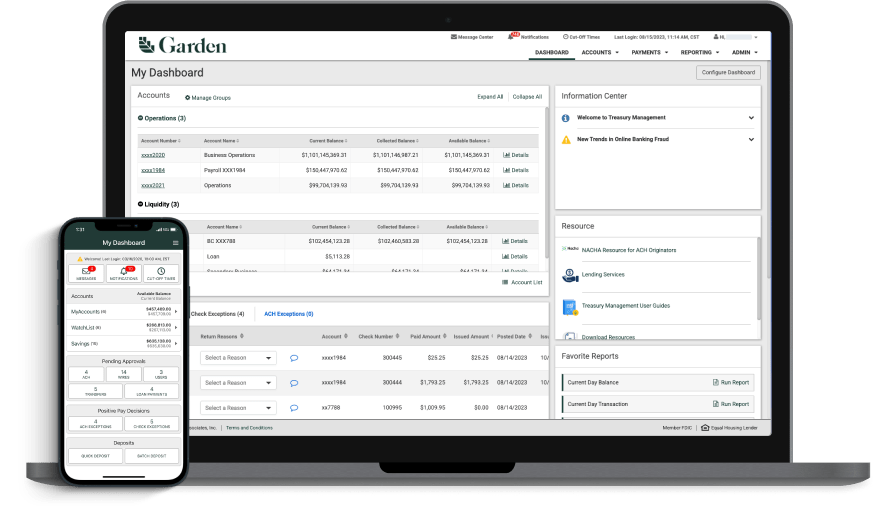

Dashboard & Report Customization

Your business users' experience is the central focus of Treasury Management, and that starts with providing a customizable dashboard. Businesses can tailor the platform to include everything that fits their workflow – and nothing that doesn't – and each user can fine-tune their personal dashboard layout to organize accounts, quickly view their most important reports, highlight items that need attention, and more. You can even share important information and resources through the Information Center and Resource Panel widgets, fully controlled by your financial institution staff.

Available Wherever People Work

Whether they’re originating payments in the office or reviewing the day's transaction history while traveling offsite, Treasury Management is secure and accessible to users anytime, anywhere, on their desktop, tablets, and mobile devices.

Case Study

see how this bank created a holistic digital banking experience with Treasury Management

Michelle Taylor

Senior VP and Director of Digital Operations & Support, Univest Bank and Trust Co.

Michelle Taylor

Senior VP and Director of Digital Operations & Support, Univest Bank and Trust Co.

The Best of Both Worlds

their business success is your business success

While Treasury Management is built to provide a stellar experience for your business users, we also have the growth of your business in mind. Revenue generation is the name of the game, and our Treasury platform is your secret weapon. The tools it provides make it easy to attract and retain commercial relationships, grow your deposits, generate fee income, and compliment credit products. Reach new milestones while making life easy for your customers – we call that a win-win situation.

Case Study

see how CommerceOne Bank used Treasury Management to increase their deposit growth

Belle Akers

Senior VP of Digital Banking & Deposit Operations, CommerceOneBank

Belle Akers

Senior VP of Digital Banking & Deposit Operations, CommerceOneBank

Treasury Management Consulting Services

let’s walk through this together

We know that adopting new processes can be hard, and product transitions can be harder. Our consulting teams are here to help at whatever capacity needed to keep you moving forward with clarity and confidence.

how does it work?

Complete Needs Assessment

To kick off the process, we'll work with you to complete a needs assessment. This helps us get an understanding of where you're at – whether you're new to Jack Henry, have been with us for years, or fall anywhere in between – and what your goals for the engagement are.

Create Timeline

Next, our consultants will meet with you to design an engagement model that maps out your transition timeline, sets up a clear training plan for your team, and gets you ready to launch, support, and sell Treasury Management.

Conclude Engagement

Finally, we'll get together to work through the engagement, leaving you prepared to use the Treasury platform to its full potential. Following the engagement, you'll even gain access to exclusive resources like detailed reference guides, parameter descriptions, and case studies.

a highly customizable program

We know every financial institution is unique – that's why our consulting services are designed to be adaptable. The length of our engagements can range from as little as one week up to three months or more, depending on your goals and timeline requirements. The topics we cover are up to you – whether you're looking to do a deep dive on payment features, learn best practices for onboarding and supporting businesses, or want to cover it all, our product experts can fine-tune the program to meet your expectations.

Interested in help with implementing Treasury Management?

Work with our consultantssupport businesses of all sizes

Treasury Management is an investment in your commercial banking strategy, built specifically to support the complex needs your corporate business users, and Banno Business gives your small and medium-sized businesses just the right tools to manage their finances, including Autobooks and Banno Conversations for BusinesTM, our best fraud-stopping solution yet. Bringing them together allows you to provide top-tier service across the entire business spectrum.