External Account Connection

become the

financial hub for your accountholders

Banno will now natively support external account connection and PFM features that will position your financial institution in the center of your accountholders’ financial lives.

Become the financial hub for your accountholders

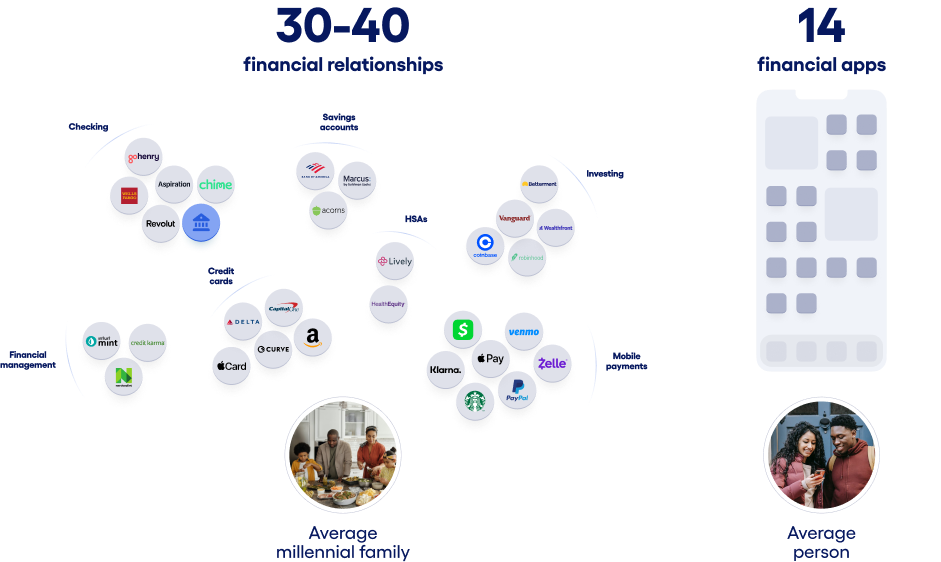

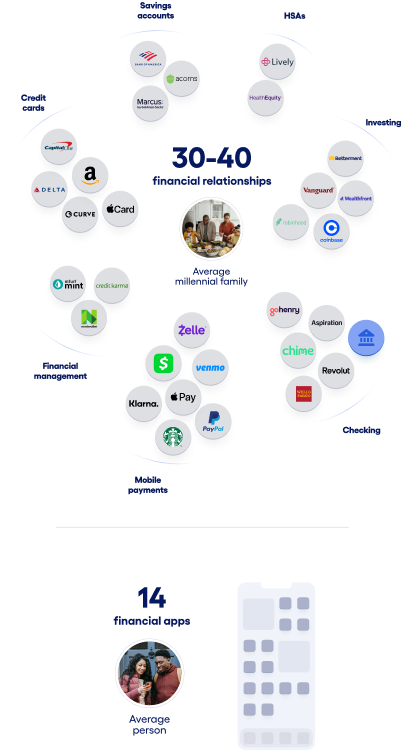

You already know that the banking industry’s competitive landscape has changed massively over time, expanding to include more than just other financial institutions and the big banks. Today, the average millennial family has 30-40 financial relationships, the average person has 14 financial apps on their phone, and their top reason for using those apps is to check their accounts’ balances and transactions1.

1 Source: Statista Research Department, 2022

what if they could see everything all within your banking app?

Until now, the only way users could bring all of their financial accounts into one place was through a personal finance management (PFM) tool, like Mint, Personal Capital, YNAB.

We’re excited to share that Banno™ will now natively support both external account connection and PFM features that will position your financial institution at the center of your accountholders’ financial lives—making your app the first place they’ll go to for checking their accounts, reviewing their transactions, and managing their finances.

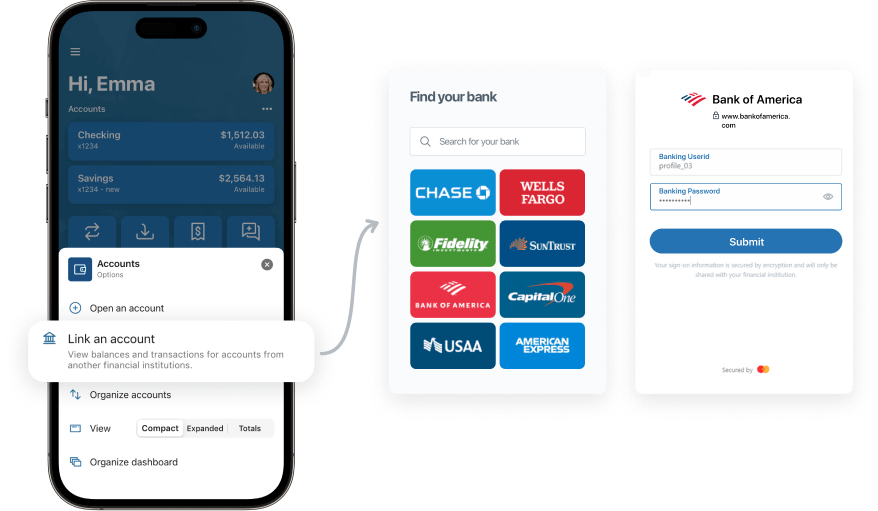

External Account Connection

connect external accounts in your app

Let’s say one of your accountholders has an American Airlines credit card they use to accumulate miles. Rather than opening a separate app to see their balance and recent transactions, and then jumping over to your app to see their debit card transactions, now that user can simply add their American Airlines credit card account into your app. And voila! That credit card displays right next to their checking and savings account, and all of their transactions can be viewed from your banking app.

Now you’re a financial hub

If accountholders are mostly opening financial apps just to check balances and recent transactions, you’ve just intercepted most of that user’s interaction with the other bank. Now multiply that by all the accounts that user has with other financial institutions. Can you see how this adds value to your accountholders and starts to benefit you and your brand?

Link an account

how does it work?

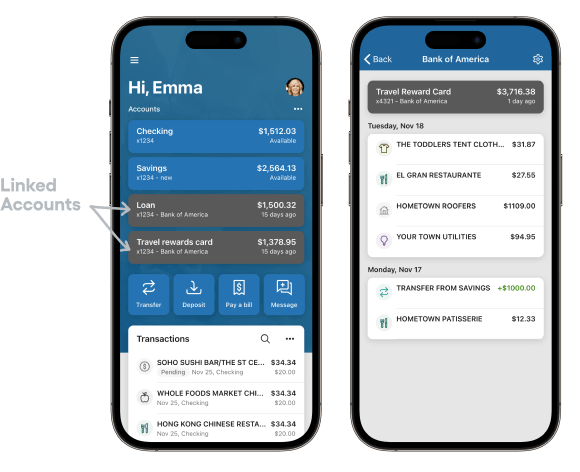

Users can link an account contextually, from multiple places in their app or online experience—from their dashboard, accounts, or settings. From this point, Finicity’s interface—matching your brand—will walk users through finding and logging into their external account.

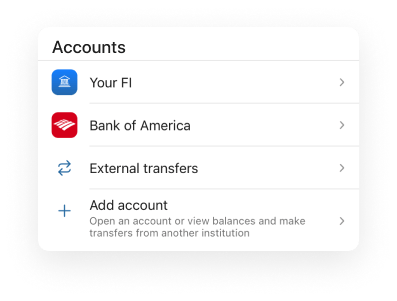

Manage multiple accounts

Once the user is authenticated, the external account will display next to yours in the Accounts section, and they can view their transactions by clicking on the external account.

Managing linked accounts can be done with account settings, and if there’s a connection issue, a message will appear to help the user correct the issue by re-verifying their credentials.

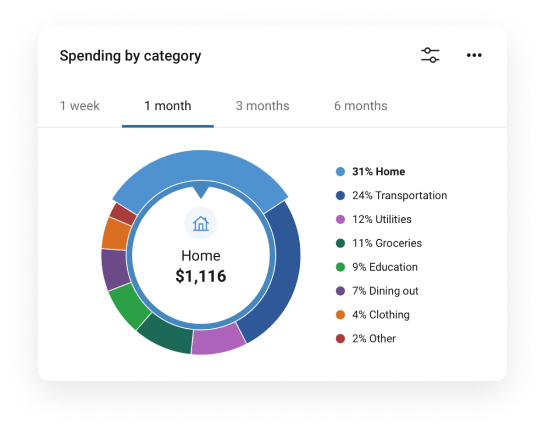

PFM in Banno

help your people manage their finances

Now that all of your users’ accounts are in one place, they can truly manage their finances and budgets—replacing the need for outside PFM tools, like Mint. This has been part of our strategy to help you become a financial hub from the start, and is why we acquired Geezeo® to bring PFM functionality to Banno.

We started by connecting Geezeo via SSO, and we are now working to completely fold Geezeo’s PFM functionality natively into Banno, beginning with the spending wheel, and eventually removing the need for an SSO completely.

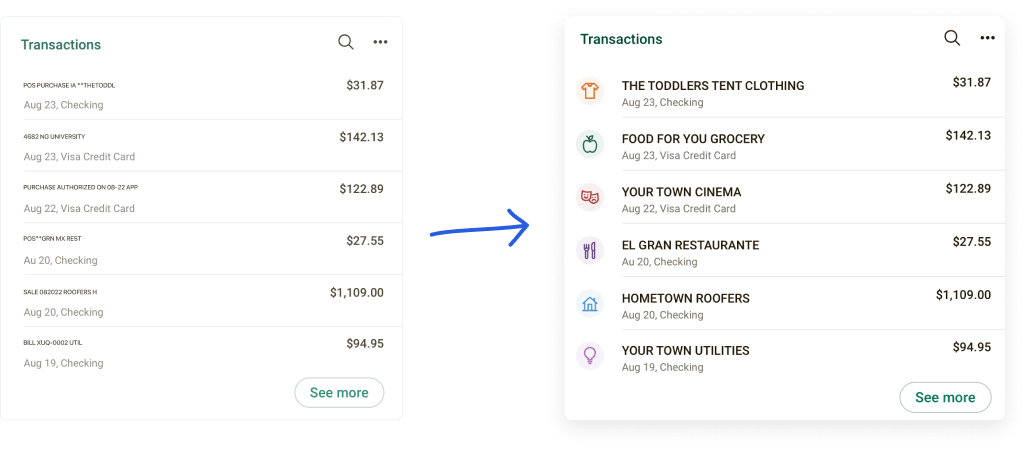

Transaction Enrichment

polish it off with rich transactions

If we’re going to bring together an accountholder’s complete financial life into one place and help them categorize transactions and build a budget, their transactions can no longer look like jumbled letters and numbers that were only ever meant to be seen by a teller.

We’ve paired Geezeo’s technology with Mastercard Places to bring Transaction Enrichment natively to Banno. This means your app will now automatically categorize transactions and generate more readable names—both for accounts with you and external accounts connected via Finicity.

Transaction Enrichment will be available to all Banno customers at no additional cost, whether utilizing Finicity and Geezeo or not.

Setting the Foundation

paving the way for new business strategies

You can’t compete for your accountholders’ 30-40 other financial relationships if you don’t know about them.

This move is foundational for the future of the Banno Digital Platform™. It’s just the first step—a building block—where you have visibility into how your accountholders are interacting, and you can begin to compete for their business.

so what’s next?

As we continue building upon the ability to connect external accounts, we’re working on how to leverage our ad engine to drive adoption from an external relationship to you. We’re also working to enable money movement between all of these with ACH, making it that much easier for users to transfer their Venmo balance into their checking account with you.

Jack Henry wants to put your financial institution at the center of your accountholders’ financial lives, turning your app into a place where they can start with you and your brand and work their way out into the financial landscape, rather than the other way around.

FAQs

We know you have questions. We want to answer them.

Transaction Enrichment and the spending wheel will be available at zero-cost, zero-lift for all customers. A Geezeo contract is not required for access to these features.

External account connection via Finicity will be bundled with Geezeo’s PFM functionality (e.g. the Budgets, Cashflow, Goals) at a cost of $0.15 per user, all in (meaning your users can connect as many accounts as they’d like for a flat rate) until April 30, 2023. The price increases to $0.20 per user, all-in, beginning May 1, 2023.

External account connection without Geezeo functionality costs the same as it does if it’s bundled with Geezeo.

This functionality does not require any additional fees, such as an Enterprise Integration Service (EIS) fee.

If you are an existing Geezeo customer, we will work with you on rolling your existing contract into your Banno contract. Please reach out to your sales representative to begin this conversation.

For existing customers, Transaction Enrichment and the spending wheel will roll out on March 21st. If you’ve previously opted for early adoption, these features will be available on March 7th.

These features will be automatically enabled for any new customers going live on the Banno Digital Platform.

External Account Connection will be available in April 2023, and it will be an estimated 30 days from a signed contract before it’s installed. More information will be provided to you as we approach rollout in April.

You can view a full list of supported financial institutions at Finicity’s website here.

If you don’t see a supported financial institution you’re looking for, please open a Support ticket with us, via the ForClients portal, indicating which financial institution you’d like to be added. Our team will then work with Finicity to add support for that financial institution.

All of the functionality discussed here—external account connection, transaction enrichment, and the spending wheel—will be available for both retail and Banno Business customers. That said, if one user of a business account connects external accounts via Finicity, those external accounts will only be visible to that user, not the entire business.

One reason we love partnering with Finicity is that they have more advanced business and commercial solutions, and we’re already planning for how those features will impact your Banno Business™ and Treasury Management accountholders beyond external account connection.

At launch, you will be able to see the externally connected accounts and transactions on an accountholder’s profile within Banno People™, and we’re already working on an interface to view aggregated data analytics across your accountholders.

This data is also accessible via our API gateway.

Please note that we have no plans to provide raw data access from externally connected accounts.

Not at this time.

If external accounts have been connected in Geezeo through CashEdge, those accounts will need to be re-connected (aggregated) in Banno’s interface through Finicity. One benefit of the need to re-connect accounts through Finicity is that Finicity’s connection has both access to more financial institutions than CashEdge, as well as support for OAuth 2.0, the latest security standard.

Working with Finicity and Mastercard was a no-brainer for us. Not only do they have the most API agreements with financial institutions and fintechs in the industry, but they are set-up to use the most secure standards on the web today – tokenized authorization with OAuth 2.0 – which matches Jack Henry’s security practices. They are also extremely consumer-friendly and care about community and regional financial institutions just as much as we do!

Not initially, but we are working toward a future where this feature is available in all products, including cores and paper statements.

Yes, the core description will be available in the transaction detail for each transaction. And, on the rare case our enrichment engine cannot provide enrichment, the original transaction description will still display.

Transaction Enrichment and auto-categorization is replacing the need for tags as they exist today, as the primary reason users tag transactions is to categorize them.

At launch, users will still be able to view and search their existing tags for past transactions in Banno Online, however users will no longer have the ability to add new tags. Tags will no longer be visible in Banno Mobile, and users will no longer have the ability to add new tags.

At launch, transactions categorized in Geezeo with default categories will update with the corresponding category in Banno. Transaction memos made in Geezeo will also reflect in Banno. An exception right now is custom categories—at launch, custom categories from Geezeo will not flow back into Banno, and will instead be categorized as “miscellaneous.” Split tagging within Geezeo is also not supported in Banno at launch and will be categorized as “miscellaneous.”

At launch, the auto-categorization of a transaction cannot be changed from Banno’s interface, however, if your financial institution uses Geezeo’s SSO, the transaction can be recategorized in Geezeo, and that change will reflect in Banno. Please note that at launch, custom categories from Geezeo will not flow back into Banno, and will instead be categorized as “miscellaneous.” Split tagging within Geezeo is also not supported in Banno at launch and will be categorized as “miscellaneous.”

We have plans to add this functionality directly into Banno as we continue to more deeply integrate Geezeo’s PFM capabilities.

Every transaction runs through our enrichment engine, whether it’s a deposit, transfer, debit, or credit transaction. That said, at this time, scheduled or pending transactions cannot be enriched. Card numbers are also not able to be displayed in this initial release, though we’re exploring this for our future roadmap.

There is not currently a setting to control access to these features from Banno’s back office suite. The Banno team can work with you individually to override one of these features if needed.

This will not have any impact on accounts that are currently linked in Banno for external transfers. Those accounts are simply linked only for transfer purposes, and users have never been able to view any account activity for these types of linked accounts.

If a user wishes to view account activity for an external account they already have linked in the External Transfers area of Banno, they will also need to connect that account in the Accounts area of Banno.

become the financial hub for your accountholders

Let's talk about what this could look like for your financial institution.