Heads Up • Online & Mobile

Change internal loan transfer type: CU

In last month's statement we announced that the Change internal loan transfer type: CU project will give your members the option to complete internal loan transfers on delinquent loans, which had not been possible due to limitations with Share Transfer records. To knock down the barrier, we've implemented the new (9) Off Cycle transfer type and can now access the Loan Transfer records needed to support internal transfers on delinquent loans.

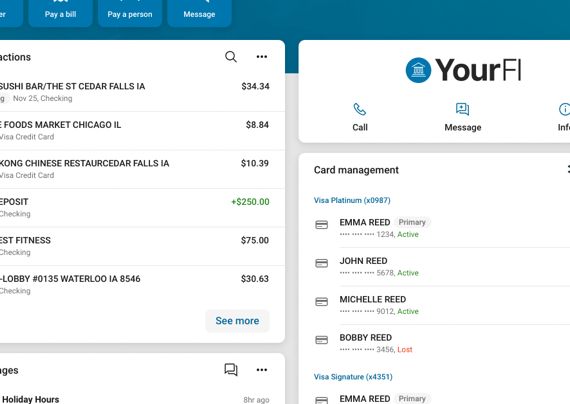

These changes will go live with Banno Mobile 2.42. Once you've worked with your SymXchange contact to ensure that the required operations (searchLoanTransferPagedSelectFields, createLoanTransfer, and updateLoanTransferByID) are enabled and everything follows the SymXchange blueprint, members will be able to create internal loan transfers on delinquent loans. Your employees will then see these loan transfers in People along with the specific member’s other transfers.

We also heard from a couple folks during the Digital Meetup who do not want to use the new (9) Off Cycle transfer type. As communicated in the SLA we sent to our credit unions, if you would like to opt out of this functionality, please complete this short survey (by June 10, 2022).