Coming soon • Toolkit & Online

Digital Toolkit: Self-serve onboarding for 3rd-party developers

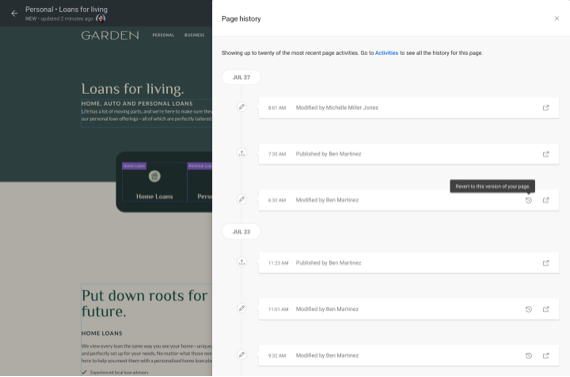

The Digital Toolkit team has long been focused on unleashing the power of the Banno API for authorized 3rd-party developers who want to build external applications on the Banno platform. Gaining API credentials, however, currently involves a high-touch, manual onboarding process that can leave developers waiting for access. That's not good enough.

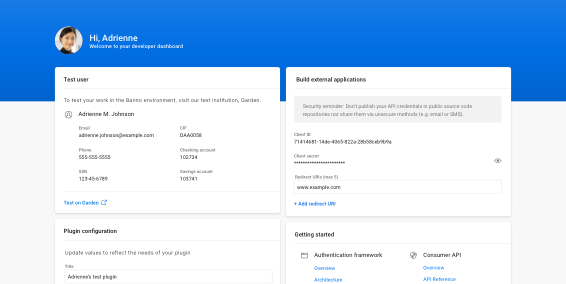

Soon, the JackHenry.Dev site will include a new self-serve solution for creating API credentials, complete with a user account for our testing and demo environment, Garden. The DIY route makes onboarding quick and easy, so developers can do what they do best: Get right to work building and testing innovative tools.

Listed as JackHenry.dev authenticated credential management on the roadmap, the feature is currently in testing and is nearly go-live ready. In the coming months, we'll add a sign-up banner to JackHenry.Dev and announce the good news in the statement.