we’re no rookies at innovation

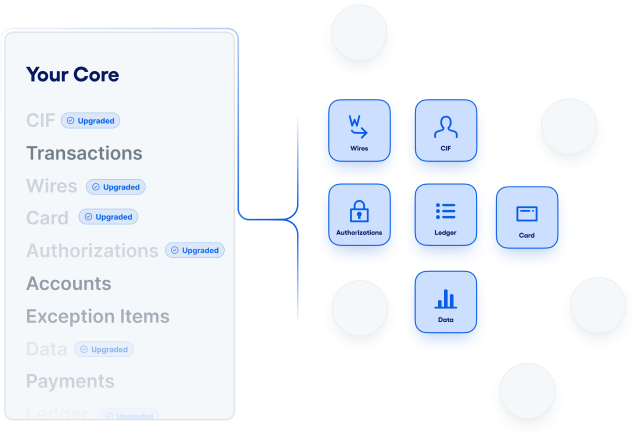

Decades ago, Jack Henry and Jerry Hall hailed the AS/400 as critical new technology on which to build next-generation banking. They made a big bet that led to a long and prosperous era of better, stronger local financial institutions offering more meaningful services and support to their respective communities. Now, cloud computing presents a similar generational opportunity to modernize and transform financial services foundationally for the good of main street institutions serving accountholders in ways never before possible.