April 2023

Permissions segments • Spanish support • Search by CIF & member number • Banno Business™ beta updates • Plus more

Watch your head! New features dropping all around. [...]

May 2023

It's truly hard to believe June is upon us already! Time has flown as the team has been hard at work delivering incredible things to you and your accountholders, and we appreciate your feedback and patience while we do so. I hope you all find some time to soak up the sun this summer. I know I will be! 😎

The long-awaited option to search for an end user by their primary identifier has passed beta testing and is finally here—for whichever core powers your financial institution! Using the previously existing search bar in Banno People, your personnel can now enter either CIF or member number (i.e., the primary identifier) to find a specific end user's profile and account details.

This new search feature requires neither configuration nor a contract, so you can let your staff know it's ready to use immediately.

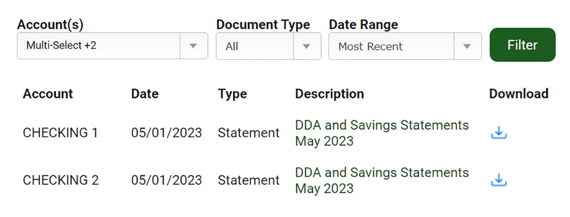

Electronic Statements Interactive (ESI) users in Treasury Management and Banno (SSOs) and NetTeller can soon filter their available statements and notices for viewing and downloading. Filtering options will include selection of one or more accounts, document types, and date ranges (e.g., Most Recent, Prior Months, and so on). That's right—gone will be the days of viewing one account at a time!

pssst! Got a little teaser, too: We’re already working on the ability to one-click download all documents displayed in the filtered results, and that should be following pretty quickly.

In beta now with three of the Treasury Management Advisory Board banks, PWA is testing well and feedback has been positive, particularly regarding key features like navigation, dashboard, account list (summary and transaction details), and payment approvals.

The next phases of beta to be released will include payment approvals and positive pay. We’ll provide additional information as we continue to work toward general availability of PWA for Treasury.

Treasury Management is now a part of the Jack Henry Resource Center! Increase your reach and take your communications to the next level with our first three assets: General Platform Overview, How to Use the TM Dashboard, and The Initial Login Experience. These are all customizable and can be modified to incorporate your bank’s brand.

If you’ve been watching with bated breath for updates on video chat and screen sharing, we have great news: Our beta period has ended, and the feature has been released for general availability! If you’re already contracted for video chat, we’ll be reaching out soon to get it enabled for your financial institution.

For more information about the feature, see our Video chat article on the Knowledge Base. If you’re interested in moving forward, reach out to our Digital Experience team for contract details.

Your end users can see bank loan interest rates again now on the Account details screen. After further investigating concerns about variable interest rates, it became clear that a) the issue only affects very specific loan types and b) the appropriate solution is to prioritize fixes for those edge cases as soon as possible.

We recognize that removing interest rates from loan details had a considerable impact on both your employees and your accountholders. Thank you for your patience while we investigated the issue and landed on the correct course of action.

Note that neither this latest change nor the initial issue with interest rates impacted credit unions.

It's time for this month's friendly reminders:

Beta testing for Spanish support on Banno Online is wrapping up and testing on Mobile is going smoothly. We anticipate making the feature generally available on Android, iOS, and Online during June, so look for a follow-up reminder in the next Statement.

Interested in making your apps multi-lingual? Contact your Digital Sales Executive to get started on the contract, or review the Spanish support collateral doc (under the "Digital Banking" heading) on the Knowledge Base for additional details.

Beta testing is underway, and the feedback has been terrific. If your financial institution has contracted with Finicity, we will reach out soon to coordinate enablement timing. For more details, see the Knowledge Base or contact your Digital Sales Executive.

The Treasury Management team is currently completing the infrastructure changes required to enable a handful of features: Issued Item Service Changes, Issued Item Voids, Account Recon Reporting, and ACH NOC and Return notices V2

Please continue monitoring announcements and, of course, the case created for your bank. For more information regarding these enhancements, visit the For Clients portal and review the initial announcement, which includes links to quick-reference guides.

We’ve put together a video which explains the basics of the Plugin Framework in fewer than 60 seconds. This ‘snackable’ content is easy to enjoy when you’re rushed for time.

You can watch the new video now on the Getting Started page for the Plugin Framework.

After another month working to fine-tune the Banno Business experience, our updates focus on a couple of new additions for both banks and credit unions:

For those of you testing or actively using Banno Business, troubleshooting is about to get easier. Once Banno Mobile version 3.3 hits the app stores in early June. The latest version features Conversations for Business, which will let your organization users start and continue those crucial support conversations even more nimbly!

In an effort to enhance the security around creating an organization user, we’re now requiring the organization administrator to pass a high-risk authentication challenge by either re-entering their password or a passkey to proceed. In the event that a bad actor gains control over an existing session, this high-risk authentication step should help ensure that they can’t create additional users without the organization administrator's knowledge.

For those who are new, onboarding, or may soon migrate to the Jack Henry Digital Banking Platform, check out our new, easy-to-share Knowledge Base overview. Want to keep your team in the know? Grab that link and send them to the Knowledge Base, an invaluable support resource for nearly 4,500 readers per month!

This month, we added or updated the following articles:

We've also added another round of product collateral docs you can download and share:

Hey hey! You're reading the first of many Banno PowerOn updates our credit union customers can expect to see in the monthly Statement.

Let's kick things off with some enhancements to our Member to Member PowerOn. After updating to v3, your members may notice that we've improved the overall experience as well as edited the user interface (UI) text for better clarity. For example, the account type now specifies share or loan and the input fields are labeled clearly on the entry screen.

This release also contains several fixes, including for a couple of noteworthy issues that impacted transfers:

If you're on an older version, just open a Support case on the For Clients portal, and we'll get you updated.

Not sure how to check your version? We've got that covered too.

Please be aware that, effective June 1, 2023, Jack Henry will no longer support Banno Mobile™ Aggregated Services (also called Banno Mobile™ PS), as further detailed in the sunset notice that we sent via SLA on April 12, 2023. We will cease all operations of Banno Mobile PS on July 1, 2024 and access to the related data will be turned off.

Here are some crucial things to understand about our plan to sunset the Banno Mobile PS application:

Please contact your Digital Sales Executive with any questions.

If you have questions about anything you have read here, please contact Support.

Release notes are posted in the For Clients portal in advance of mobile releases and contain a rollup of all client-side changes made to Banno within the period.

Want to stay in the know about the latest features and enhancements we’re making to the Jack Henry Digital Banking Platform? Subscribe below and you’ll receive an email straight to your inbox every month when the Digital Banking Statement hits the press!

SubscribeWatch your head! New features dropping all around. [...]

Summer is in full swing, and so is your team of partners at Jack Henry Digital! [...]

Let's talk about what this could look like for your financial institution.