March 2023

Video Chat in beta • Linking third-party accounts • Banno Business™ beta updates • Plus more

Our teams have a great lineup for this month’s Statement, and more exciting changes are on deck! [...]

April 2023

What is it about nice weather that makes time move so much faster!? We don’t know about you all, but we blinked and April is practically over. With spring flying by and summer drawing near, we’re already planning all the exciting things – both personally and professionally.

We’ve been cranking away all month and we’re excited to share some brand new features with more on the way! So dive in, read carefully, and we’ll see you at our Digital Banking Meetup in May!

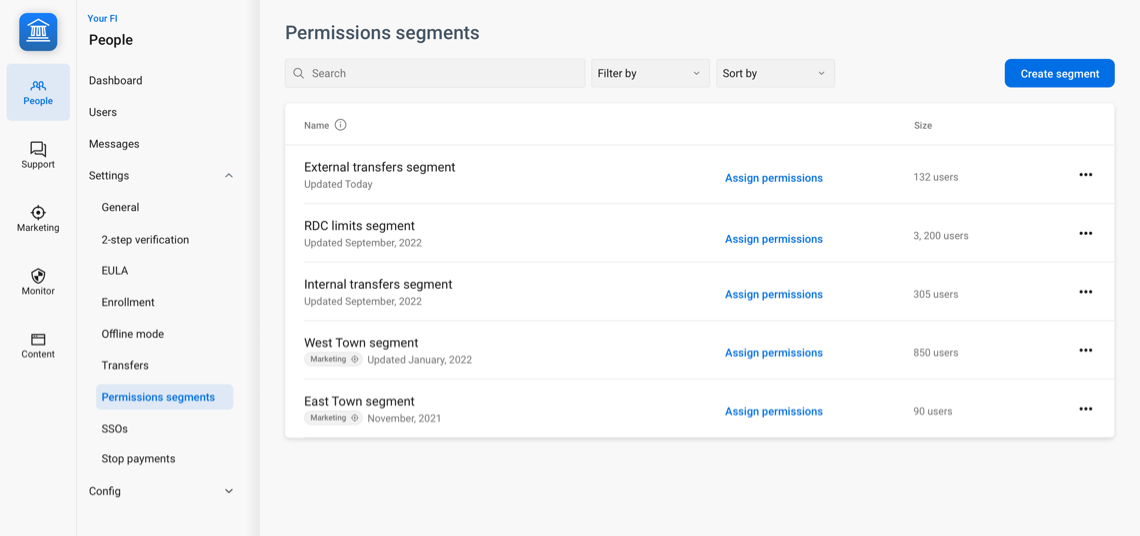

Stop us if you've heard this one... The option to bulk-assign transfers permissions to a group of users is almost here. No really! After numerous delays during beta testing (due to scheduling difficulties, not issues with the feature), we have thoroughly tested Permissions segments and are officially approved to release it for all customers early next week—most likely, Monday May 1.

As you may recall from the November 2022 Statement, no configuration, contract, or support request is necessary for Permissions segments. Therefore, starting next week, your employees with the Manage everything - users, messages & settings permission for Banno Admin can carefully review the documentation and bulk-assign transfers permissions as needed.

What's next for segments? While the projects are not yet scheduled, we will soon add functionality to bulk-assign permissions for managing External apps, Plugin cards, and Zelle®. Once that additional work has been slated, we'll include an update on timing in a future Statement.

We’re thrilled to announce that Banno Mobile and Online will soon be available in Spanish! Enabling our Spanish support feature will make your digital arm immediately more accessible and inclusive to almost 42 million Spanish-speaking consumers in the United States alone. The chance to provide a better digital banking experience for so many people has us super excited to get this feature in your hands.

We’re already working with beta customers and will continue testing throughout May. We expect to offer Banno Mobile and Online in Spanish for all interested financial institutions at some point this summer. In the meantime, you can reach out to your Digital Sales Executive to get contracted.

Stay tuned for updates and any additional details we're able to share as we get closer to general availability.

During April, the Treasury team has been heads down, working on three terrific enhancements that will make your end users' tasks easier while further improving security.

Treasury Management has enhanced the Create ACH Payment ~ Upload Nacha File functionality to pull the effective date from the Batch Header record of the uploaded file. This enhancement was enabled in UAT on Friday, April 28 and is scheduled to be enabled in Production on Friday, May 5. You can read more information about these changes on For Clients.

Treasury Management teams are working hard to bring Unified Identity Service (UIS) to the Treasury platform. While we don’t have an exact timeline to share yet, we’ve published an FAQ on For Clients that provides information regarding what to expect from the user experience and migration process.

We’re currently conducting beta testing on an exciting new delivery channel for wires. This feature allows businesses to send wire files via a Secure File Transfer Protocol (sFTP) data transmission. In other words, your end users will soon be able to view, process, and delete files within Treasury Management!

The initial focus of the feature is to give users a more-secure way to review files, followed by an option process files. A future focus will be to implement straight-through processing, which will not require user intervention. We should also note that we will be offering the feature as a fee-based solution.

Stay tuned to the Statement for more information soon!

We've got just a couple of reminders for you this month, plus a heads-up about older versions of the Mobile apps:

As an added security precaution, we will begin enforcing a minimum-version requirement for the Mobile apps. Starting in early May, any user who has not installed Banno Mobile version 2.35 or newer will be prompted to update to the latest version of the app.

As announced last month, transaction tags are once again available in Banno Online™.Transaction tag functionality has since been restored in Banno Mobile™ as well (Android version 3.1.1 and iOS version 3.1.2).

Our Video chat beta testing is well underway, and the feedback has been great so far. To get prepped and contracted for Video chat and screen sharing, please contact your Digital Sales Executive.

Alright, this doesn't quite fit the Toolkit Corner theme you usually see in the Monthly Statement, but the same Developer Relations team has some good news to share for credit unions: Your in-house or third-party developers will notice that we've updated the look and feel of the SymXchange API docs to match the look and feel of the Digital Toolkit docs and the Enterprise Solutions docs.

This update brings more consistency to the experience of reading the developer docs and brings more control to read the docs in light mode or dark mode.

You’ve heard us talk about making your financial institution the digital hub for your accountholders, and we’re ready to make that happen. Beta testers are currently linking third-party accounts within their apps, and the feedback for this new feature has been great! We’re almost ready to enable this feature for those of you who have contracted with Finicity, and we’ll be reaching out soon to coordinate a timeline that works for you.

You'll also remember that you can check out far more details in the Link an account from another financial institution article that we added to the Knowledge Base last month. For information on offering this feature, please contact your Digital Sales Executive.

Contrary to an errant line in last month's Statement, no support case is required to enable Direct Connect. On April 25, we deployed a security enhancement to all customers who have contracted for the Direct Connect product, solely using the Banno platform for online banking. End users on Treasury Management were not affected.

For a functionality refresher, see our Direct Connect article and watch our related YouTube video, which provides steps to help your end users authenticate now that this security feature is in place.

Bank customers can contract for Direct Connect by reaching out to your Digital Sales Executive, so we can include this security feature in the implementation for your financial institution.

You asked for it, and now we’re working on it. Clearly, CIF and member number are the two primary identifiers for end users. Soon, your financial institution's admins will be able to search for an end user by those IDs. Admins will simply enter the CIF or member number in the search box in People and presto-chango, the user should appear!

There's not much else to report on this small-but-mighty enhancement, other than to mention that no additional contract or configuration is required. We will announce the news here once your team can start searching by CIF and member number.

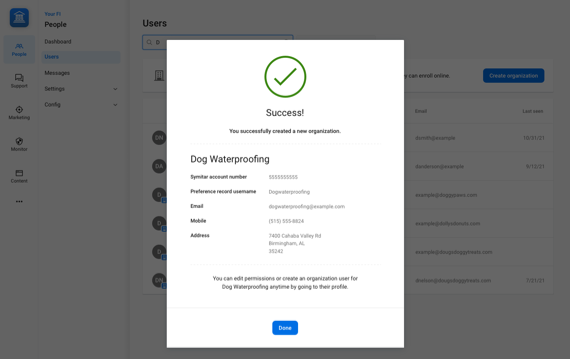

We’re getting close to wrapping up the first batch of features for Credit Union Banno Business beta customers! Take a look at the exciting new features customers will have access to.

Credit union organizations are now fully visible and can be managed from within People. ACH, Transfers, Wires and User management permissions for the organization can now be customized to suit the needs of the organization. Credit unions can also manage the permissions at the account level—providing premier configurability to fit the needs of small businesses.

Credit union organization users are also now fully visible and can be managed from both People and Online. Your financial institution's administrators can customize each user at the organization, changing which features and accounts they have access to. Organization administrators have access to this same functionality through User management in Online, thereby taking the responsibility of configuration and support off of your personnel.

This month, we added or edited the following Knowledge Base articles:

If you have questions about anything you have read here, please contact Support.

Release notes are posted in the For Clients portal in advance of mobile releases and contain a rollup of all client-side changes made to Banno within the period.

Want to stay in the know about the latest features and enhancements we’re making to the Jack Henry Digital Banking Platform? Subscribe below and you’ll receive an email straight to your inbox every month when the Digital Banking Statement hits the press!

SubscribeOur teams have a great lineup for this month’s Statement, and more exciting changes are on deck! [...]

Time to soak up some sun, right after you soak up the latest from Jack Henry Digital! [...]

Let's talk about what this could look like for your financial institution.