January 2023

Treasury joins the Statement • 2FA improvement for employees • minor ESI enhancement • Geezeo and Direct Connect updates • Plus more

Welcome to 2023 with Jack Henry Digital and the Banno Platform! [...]

February 2023

Punxsutawney Phil's dang ol' shadow may have cursed us to six more weeks of winter, but that didn't stop February from flying by. If you're not already counting at home, I can tell you there are exactly zero days left this month, which leaves just a couple weeks of "extra winter" left. We can do this, people!

Reading this update-packed Statement and trying out the latest features oughta help make the next few weeks a little less gloomy until spring comes to the rescue.

Treasury Management banks were sent an SLA on Wednesday, February 8 regarding some upcoming enhancements that require pre-work from our internal partners. Note that no action is required on your part, but we ask that you please be sure to leave the case open and active so we can bring you these awesome new features:

You can read more details about these enhancements on the For Clients Portal.

We’re excited to share the news that we've added the library of Quick Reference Guides (QRGs) for Treasury Management to the Jack Henry Digital Knowledge Base. What does this mean? Now you can access all of the Digital collateral in one place! We’ll still continue to publish our Treasury Management QRGs on the For Clients portal while we ensure any existing links are updated, so no worries if you have any of these guides bookmarked.

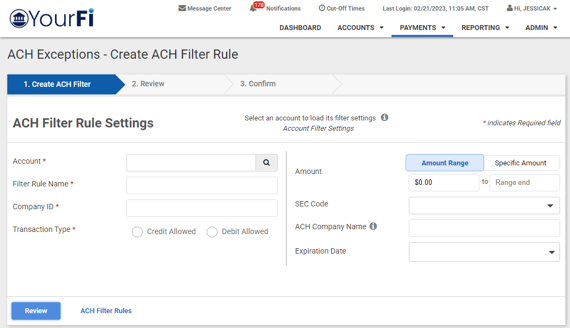

Want to take some work off of your plate? Take a look at the ACH filter rules enhancement that was released mid-2022! This feature allows your users to manage their own fraud mitigation controls by filtering out unauthorized ACH transactions. Recently we discovered that only about half of our Treasury banks have this time-saving feature enabled. So tell us, what are you waiting for?

Take another look at the ACH Filter Rules QRG on the Knowledge Base for more information.

For everyone watching the NACHA rule enforcement dates closely, rest assured that we are as well. After reviewing the phase 2 requirements, our assessment is that Jack Henry currently meets these requirements for all four cores.

Our Mobile teams began uploading the latest major release, Banno Mobile 3.0, to the app stores this afternoon (Feb. 28), and you can see details on everything this version includes on For Clients—in the release notes labeled Banno-Release-Notes-2023-02-27.

Related to new features included in Mobile 3.0, we also deployed an Online release yesterday to add support for transaction enrichments and remove the ability to add legacy tags (yet still allow searching and viewing them).

For details on how these latest releases pave the way for enabling transaction enrichments and the spending wheel, don't miss the "Powerful PFM capabilities" article in this Statement.

Please also be aware that Banno Mobile 3.1 will have an earlier-than-usual code freeze, so we can begin support for linking third-party accounts via Finicity as soon as possible. We're targeting a release date during the second half of March.

For more information on tag removal, transaction enrichments, and third-party accounts, see our new External Account Connection page.

Today for banks that offer loan accounts, we display a fixed interest rate for all loan account types. This is suitable for many types of loans; however, there are specific loan accounts that should instead display a variable interest rate—which is not possible within Banno today. Rather than potentially misinforming users, soon we will remove interest rates from the Account details screen for loan accounts.

This change—which will not impact credit unions—is obviously intended as a short-term solution. Our Product and Engineering teams are scoping out the work required for an appropriate long-term solution. Please keep an eye on the statement for a follow-up announcement, which we will provide as soon as we have more information to share.

Here are a few reminders you'll want to keep on your radar:

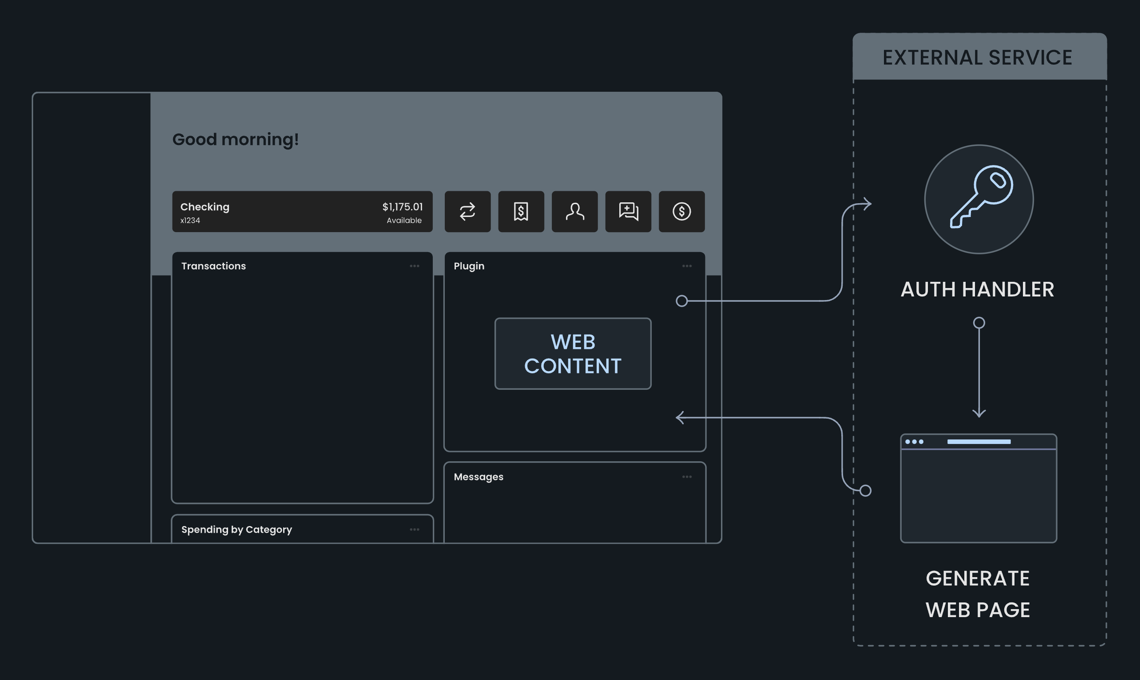

As we mentioned in the February Digital Banking Meetup, starting in July 2023, the Banno Digital Platform™ will no longer be supporting inbound aggregation, also known as screen scraping. As we've discussed, our team has worked hard on getting broad coverage for you and your accountholders by establishing partnerships with all of the top aggregators. We’ll continue to share more information on this in the months ahead.

Don’t forget to join us for the upcoming EWF webinar, where we’ll discuss the new integration between our Banno Digital Platform™ and jhaEnterprise Workflow™ (EWF) and teach you how these solutions work in harmony to help you meet your goals and your accountholders’ needs. Grab your seat today!

If your institution has any users with Singapore-based mobile phone numbers, they will temporarily see an unfortunate "spam likely" warning included with the 2-step verification codes Banno sends via our SMS short code number. For details about that warning and what we're doing to resolve the issue, please revisit last month's statement.

We’ve updated the look and feel of the illustrations used within the Digital Toolkit docs and made them easier on the eyes in both light and dark mode.

To align with the latest industry standards, we have relabeled the biometric login feature of Banno Online to Sign in with a passkey. Coinciding with this name change, we also enabled a newer browser autocomplete feature to make signing in with a passkey even easier, especially on mobile browsers.

Note that the functionality of biometric login (now called "passkey login") itself has not changed since we first introduced the feature 2 years ago. Therefore, in addition to the resource materials below, we recommend reviewing the Biometric login for web apps using webauthn article that our Head of Engineering Chad Killingsworth published in March 2021.

For more crucial details, please read the Passkeys section we've added to our "Authentication and Security" guide as well as the net-new Sign in with a passkey article.

You can learn even more about passkeys here:

Drum roll please … Banno Business beta credit unions are finally getting their first taste of business functionality! Our teams are working furiously these days to ensure we get things into the hands of our beta customers as fast as we can. Take a look at the first features that are ready for use.

Available in People: Create and view organizations

Our first feature drop for credit unions will give your employees the ability to create new organizations from within People. This will allow credit unions to begin to support their small business members by creating an organization based on an existing Symitar account. Once created, the organization will be searchable from People just like existing users today.

Coming soon in People & Online: Create and view organization users

Our engineering teams are so close to being able to deliver this functionality, but it’s still not quite ready to make it out the door this month. In the very near future, credit unions can look forward to being able to add and invite new users to their organizations – all from within People. Alternatively, once an organization administrator has been created, they can also add and invite new users from within Online.

Keep your eyes peeled for new features coming each month. We’re so excited to finally start getting them into your hands!

Coming in March and April, we’re walking our talk by introducing some potent Personal Financial Management (PFM) features into our apps to truly start making your app the financial hub for your users.

In March, we’re rolling out our Geezeo™ transaction enrichments and the spending wheel to most financial institutions, and we will continue working to enable these features for everyone else over the coming months. Remember, transaction enrichment and the spending wheel will be available at zero-cost, zero-lift for all customers. A Geezeo contract is not required for access to these features.

For your institution's specifics and rollout timing, please reference the related SLAs we sent (on Jan. 25 and Feb. 15) as well as the Transaction enrichment article on the Knowledge Base.

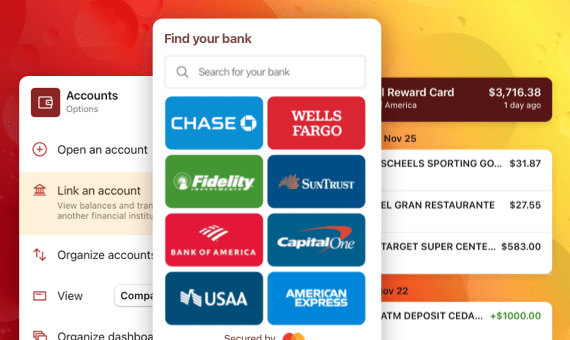

In April, connected accounts will become available to those who have contracted for Finicity, enabling your accountholders to link external accounts and view balances and transactions within Mobile or Online. We’ve put together this External Account Connection page, which describes the functionality of connected accounts in detail and covers many frequently asked questions. If you haven’t spoken with your Digital Experience Sales Executive yet, you have until April 30, 2023 to snag promotional pricing: digitalexperience@jackhenry.com

This is just the beginning of what you can expect from our PFM capabilities. We can’t wait to continue building upon this foundation.

In addition to new docs for Transaction enrichment, Passkeys, and Banno Business, don't miss these documentation updates:

We're also excited to let you know that the Banno Help Center will have a brand-new look and offer a much-improved experience very soon! Stay tuned for an update next month, and be sure to visit the Help Center between now and then, as the new digs are currently on track for unveiling sooner than later.

If you have questions about anything you have read here, please contact Support.

Release notes are posted in the For Clients portal in advance of mobile releases and contain a rollup of all client-side changes made to Banno within the period.

Want to stay in the know about the latest features and enhancements we’re making to the Jack Henry Digital Banking Platform? Subscribe below and you’ll receive an email straight to your inbox every month when the Digital Banking Statement hits the press!

SubscribeWelcome to 2023 with Jack Henry Digital and the Banno Platform! [...]

Our teams have a great lineup for this month’s Statement, and more exciting changes are on deck! [...]

Let's talk about what this could look like for your financial institution.