Heads Up • Banno Online™ & Banno Mobile™

Account balance check for immediate external transfers

Next Wednesday, September 6, we will be enabling an immediate balance check during the creation of an immediate external transfer feature for the small percentage of CIF 20/20 and Silverlake customers who have not previously requested this security setting.

The security benefit

To further increase our protections against bad actors and fraudulent account takeover attempts, our security and engineering leadership teams have determined that this formerly optional feature must shift to a required setting (as detailed in the related SLA sent on August 17*). While enabling this security feature should not be considered a magic bullet to eliminating fraud and financial loss entirely, we believe this is a step we can take immediately to help mitigate the inherent risk around money movement.

*If you did not receive the SLA we sent on August 17, then your financial institution has already had the feature enabled.

No action needed

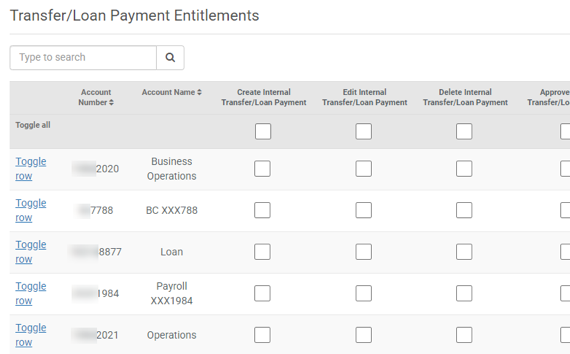

This change requires no action on your part, and we will apply the same balance table configuration for immediate external transfers as you have determined for immediate internal transfers. If you have any questions, please open a case on the For Clients portal; select Banno Online as your product, and our support team will can assist in updating your financial institution configurations.