June 2023

Case tag reporting, TM Wires enhancements, CD Renew PowerOn update • Plus more

Summer is in full swing, and so is your team of partners at Jack Henry Digital! [...]

July 2023

July went off like a firework — 💥 boom 💥 and it disappeared into thin air! That's alright, though. With all these irons in the fire for Banno Business™ and the Digital Platform, it's best we keep our eyes locked on the road we're building.

The team has been hard at work this month to deliver you all some dazzling updates, so we hope you’ll enjoy these hot, hot, hot items!

One enhancement has been made to the Check Withdrawal PowerOn, which now gives credit unions the option to define minimum and maximum withdrawal amounts. If you are interested in installing or upgrading the Check Withdrawal PowerOn, please submit a Support case on the For Clients portal.

Need to check your Check Withdrawal PowerOn version? Just follow these steps.

As you may recall from the January Statement, we were working to register our 53286 SMS short code number with the Infocomm Media Development Company (IMDC), so end users with a Singapore cell number can continue receiving our 2FA log-in codes via SMS.

Unfortunately, we aren't able to register the number with the IMDC. Therefore, on August 1, 2023, Singapore will block that small fraction of end users from receiving our 2FA log-in codes via SMS and will need to select a different 2FA verification method. Apologies for the hassle!

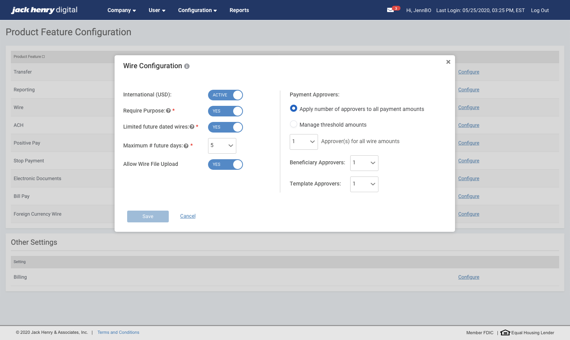

Want to give your high-volume wire originators an easier way to input their wires into Treasury Management? Be sure to revisit the Wire File Upload enhancement. This feature allows your companies to use a file mapping tool to create or update upload formats and bulk-upload their wires. More information on this time-saving feature can be found in the Wire File Upload Quick Reference Guide (QRG).

Remember, these days you can see all of the Treasury Management QRGs on our Knowledge Base, including one for the Wire File Data Transmission via sFTP feature we announced last month. Be sure to check all our QRGs for a feature or three that can enhance the platform for your users!

Hey hey! You're invited to visit the Digital Knowledge Base homepage, where you'll notice a refreshed design. To serve up our most-relevant documentation front and center, we cut the (inessential) navigational cards in favor of quick-links to six commonly searched items from within and outside the Knowledge Base, plus a dynamically updated list of links to our most recently published docs.

Speaking of our latest docs, here are links to a few standouts we think will be of particular interest:

Please keep these reminders in mind:

As detailed in the SLA we sent on Thursday, July 27 (also labeled "Banno Apps Security Changes"), we will be making a series of security changes to the Banno Platform over the next several months.

These changes, which reflect tremendous improvements by the web browsers and mobile platforms we support, will require many individual releases across multiple services. We will use the Statement and Release Notes to notify you as each change is made.

We've had a few recent requests to establish complete consistency across the platform. We agree that general consistency is a crucial aspect of the user experience. That said, it's equally important to follow established industry best practices for the various operating systems and device types we support.

Interested to learn a bit more about instances of purposeful platform differences? Of course!

Another month, another ‘snackable’ video to help you learn more about the Digital Toolkit. This time you’ll enjoy 60 seconds or so learning about the Admin API which is the API that powers the back office in Banno Admin.

See the new video now on the Getting Started page for the Admin API.

Our teams have been heads down recently, working on new functionality for our Banno Business customers. Here’s a peek behind the curtain at some of the functionality that will be available to customers in the coming months.

Available soon to not only our banks using Banno Business but also to any banks using NetTeller Cash Management (NTCM). Until now, bank employees haven't had the option to send a user a reset password link. Instead, they needed to rely on either NetTeller Back Office or reach out to an organization administrator.

Soon your employees will be able to send NTCM and organization users a link to reset their password right from People!

Sometimes things don’t go as planned. Picture it: You transmitted a wire after the bank’s cutoff time, forgot to name your file for upload, or added too many characters in a field. Now, you need to know what went wrong so you can make the necessary adjustments.

We know how critical this moment is, and we’re diligently working on improving the error messages across Banno Business to provide more specific messaging and guidance—for this and other scenarios.

We know our business banking customers are busy, so we’re actively working to bring you wire transactions on the go. Banno Business users will be able to create and transmit wires within the Banno Mobile app, not to mention view their wires in each status.

Our teams have been circling back around on the workflow for credit unions when creating an organization. We received feedback that it would be nice to check for typos (we here that! 😏) before using the details of an account to create an organization.

To that end, we’ll be swapping out the speed-bump confirmation step for an Account details preview screen, which should help reduce the number of organizations created accidentally based on the wrong account number.

Your employees will be glad to hear that we’re investing proper time to support making account-access modifications on behalf of a business organization. Presently, such modifications must be handled in Symitar® and sync’d with Banno before the accounts are visible in Banno People.

Rest assured, we understand how irritating that extra step is, and we're working on the solution to handle such organization management from start to finish.

Managing risk is a key priority for our business clients. That’s why we’re proud to provide our credit union business clients with a pre-processing verification of funds in offset accounts. Before genearating your NACHA file, you'll be able to check whether the offset account selected for the batch has the funds to cover outgoing transactions.

When an ACH batch is submitted for processing on the next business day, the batch must be received before your financial institution's cutoff time (on the day it's submitted). Therefore, we’re adding a setting that will let your credit union employees update this cutoff time for days when you might need to process earlier or later.

For our credit union business clients, we’ve added freeform creation of ACH batches. Create a batch by entering header details and then manually enter recipient data. Have an existing batch that needs some corrections? No problem! We added freeform editing, too.

Credit union customers will be using Alkami’s ACH Alert product—via an SSO link within Banno—for their Positive Pay services.

If you have questions about anything you have read here, please contact Support.

Release notes are posted in the For Clients portal in advance of mobile releases and contain a rollup of all client-side changes made to Banno within the period.

Want to stay in the know about the latest features and enhancements we’re making to the Jack Henry Digital Banking Platform? Subscribe below and you’ll receive an email straight to your inbox every month when the Digital Banking Statement hits the press!

SubscribeSummer is in full swing, and so is your team of partners at Jack Henry Digital! [...]

Now that you've enjoyed a well-deserved Labor Day weekend, take a gander at [...]

Let's talk about what this could look like for your financial institution.