Banno Business™ updates • Banno Online™ & Banno Admin

User management and Wires updates for Credit Union beta testers

Our Banno Business for Credit Unions beta customers have been patiently anticipating new functionality for quite some time, so we’re happy to say that we are wrapping up the early-round beta releases involving a hefty set of features. We're set to start beta testing some critical aspects of organization and member management as well as domestic wires management.

Take a closer look at what’s ready and coming soon for credit unions!

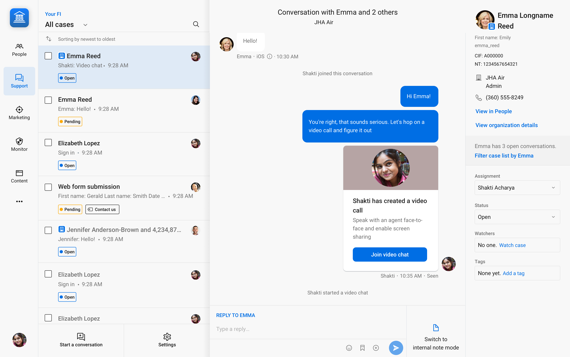

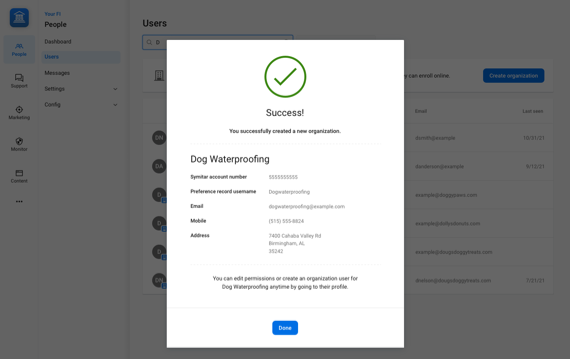

Available in People and Online: Create and view organization members

At long last, credit unions can add and invite new members to organizations from within People! While it took longer than anticipated, we're extremely excited to have this feature in your hands. Additionally, once the first organization administrator has been created, that administrator can then add new members to their organization within Banno Online. Self-service for the win!

Coming soon in People: View and manage organization accounts and permissions

Once an organization has been created, the next logical steps are viewing and managing it. We’re working hard to build the capability into People, where Credit Union employees can enable accounts, permissions, and account permissions for the organization. Soon, we’ll add the option to edit ACH, Wires, and Transfers permissions (and more!) in People.

Coming soon in People & Online: View and manage organization member accounts and permissions

When we’re talking about small business banking, it's obvious that credit union employees' and organization administrators' needs stretch beyond the ability to create members. You also need more granular control over which accounts an organization’s members can access and what they can do with those accounts. We’ve got you covered there. We're firing on all cylinders to build functionality—in both People and Online—for customizing an individual organization member's accounts and permissions.

Coming soon in People & Online: Create, manage, and transmit domestic wires

Our credit union customers have made it clear giving their organization members a way to quickly and securely send domestic wires is among your highest priorities. Rest assured, your members will soon be able to create, manage, and transmit wires for any wire-eligible account. They will also be able to view all wires that have been processed or are pending transmission. Equally important to any financial institution, your authorized staff will be able to fine-tune account settings and establish wire limits.

There's so much exciting Banno Business functionality coming out of our development teams these days that we're already looking forward to sharing more updates in the April Statement. Stay tuned for more!