Coming [BACK!] Soon • Online

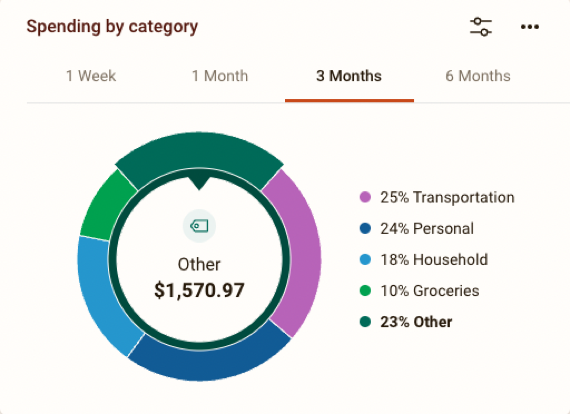

Geezeo Spending wheel and dashboard cards

First off, we want to say that we recognize we messed up here, and we apologize that it has taken us so long to get this corrected. But we have good news! We’ve found the source of the issues that have been plaguing these features, and we are working diligently to get them back in your hands during October. We will be re-releasing the Spending Wheel and all four Geezeo Insights Cards including: Budgets, Cashflow, Goals, and Net worth.

Again, we appreciate your patience and understanding. There's no support case needed for these features, so please stay tuned for enablement details in next month's statement!