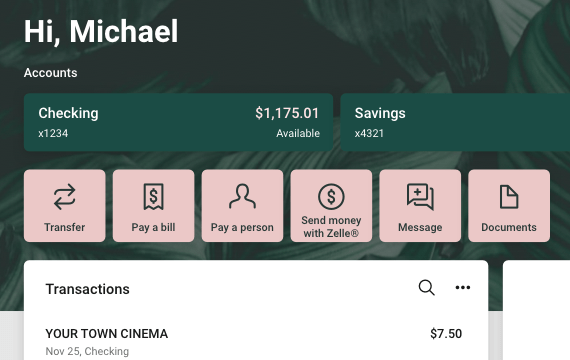

New feature • Mobile, Online, & People

View hold amounts and other balance details

Starting with our 2.32 Mobile release, your users will be able to view hold amounts and other balance details like sweep amount, overdraft limit, and more! This requires you display Available as the primary balance in Banno, and that each individual field is also configured in your Available Balance Calculation Tables. To get into the weeds, Banno will show the attributes selected in DDPAR 40 (Silverlake) or DDPAR 27 (CIF 20/20) for the appropriate table, which have a corresponding balance.

Beyond that, no configuration nor support case is required. This feature is currently limited to banks using either the Silverlake or CIF 20/20 core and will begin displaying for users inside of the balance info dialog as information is available—individual fields, such as hold amount, will only display if a hold exists.