New feature • Mobile & Online

Open sesame: Easier and faster account recovery

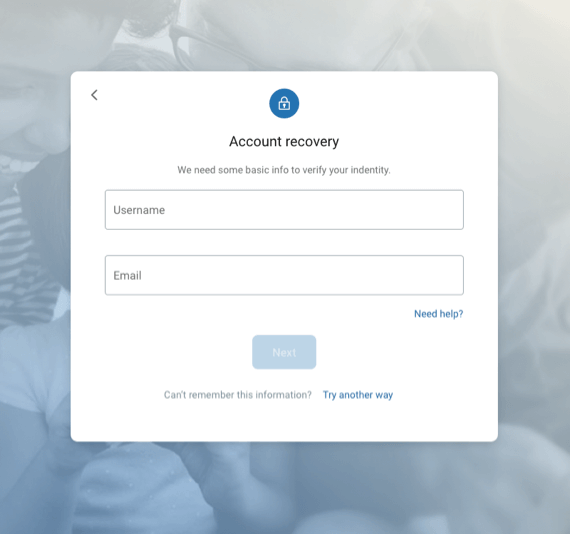

Picture this: Someone needs to make an important transaction, but in their hurry to sign in, they’ve managed to lock their account. Now they’re too rattled to remember a long account number and their SSN (or tax ID). And without access to Conversations, contacting your support staff could present a frustrating hassle. Thankfully, we’re making it easier for your users to recover access—without the need to send an SOS flare to support! Slated for release in early June, the new default account recovery method will require the user to provide only their username and email. The option to use their account number and tax ID as verification will remain available as an alternative.

Want more great news? This improvement is coming to all users with no configuration necessary—and we’ve even added self-serve account recovery support for cash management users.