December 2019

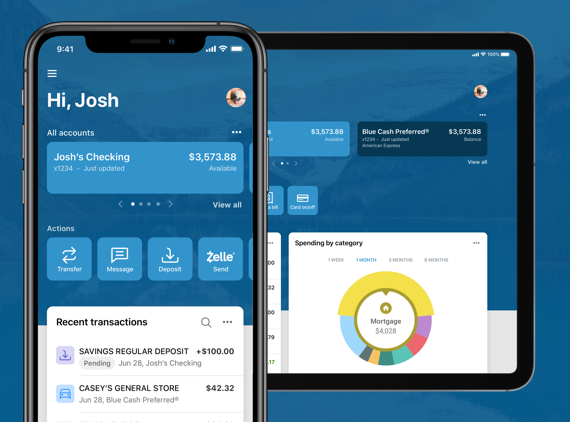

Face unlock on Android, send verification codes, in-app review prompts, & more

All of our updates this month are really exciting and impactful to you and your users, including updates about our new Banno Online sign in experience, the ability to initiate a password reset and user unlock, case routing and automation, support inbox improvements, new self-enrollment settings, and more.