New feature • Apps

Access to more transaction history

We’ve recently completed a new feature that will allow your users to access more transaction history than was previously available. When this feature is enabled, Banno will begin pulling all available transaction history from the core into the Banno layer. For newly onboarded financial institutions as well as recently opened accounts, this process will kick off as soon as we discover those accounts.

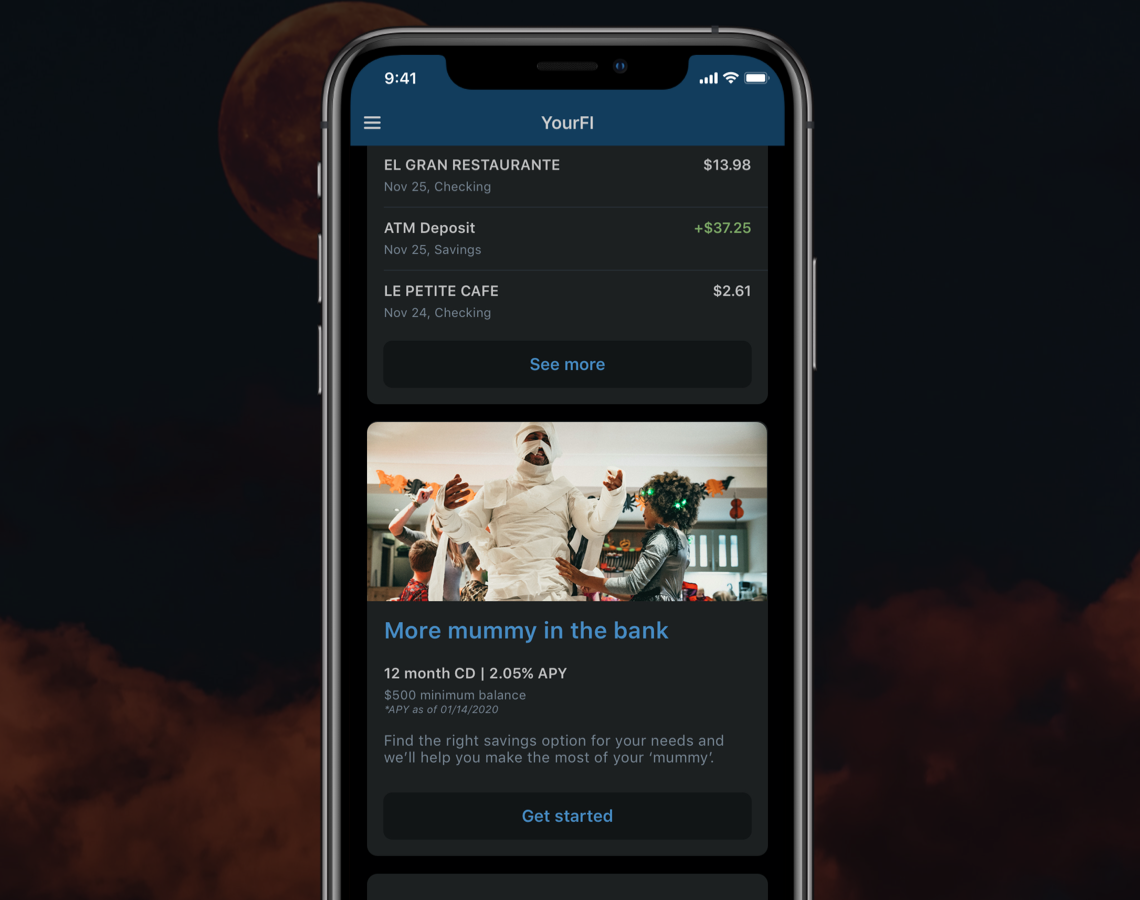

To access these transactions in-app, users just need to search their transactions lists and tap the ‘See more’ button to begin pulling them into the app.

Banno already stores transactions in our layer indefinitely, so there is limited benefit for those who have been live for a year or more. We will be doing a gradual roll out of this feature, but it will be enabled by default for all newly onboarded financial institutions and for all of our live, core-connected banks in a few short months. No support case is needed to enable this. We are actively working on implementing a similar feature for credit unions, so stay tuned!