New features

External transfer enhancements

In the latest version of Banno Mobile™ and Banno Online™, we've added two new features that give you more control over transfers made.

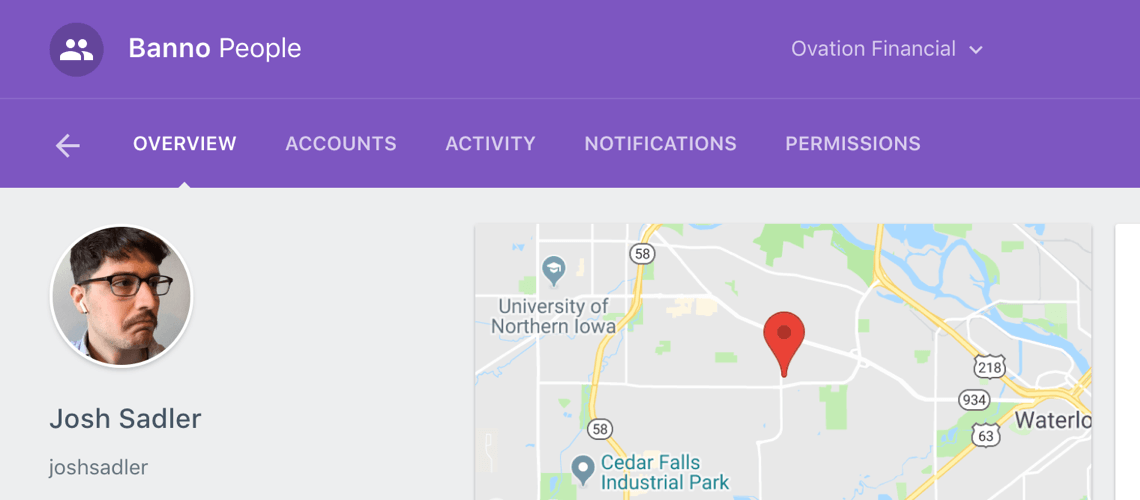

In Banno People℠, you can now set a dollar limit on external transfers that, if exceeded, will force a user to enter their password before the transfer is submitted. We've also added a velocity control for external transfers to limit the number of times a user can create an external transfer per day.

These configurations are available in Banno People℠ for anyone with external transfers enabled.

Banno now allows the account that funds your micro-deposits used for external transfer account verification to be overdrawn. This is for you if you're not keen on keeping that account funded.