Embedded Fintech

differentiate yourself with an open platform

Jack Henry's open banking platform seamlessly integrates sought-after fintech into your digital banking experience, giving you optionality as you build your strategy and differentiate yourself from other financial institutions.

Explore Developer DocsEmbedded Fintech

you can make strategy fun again

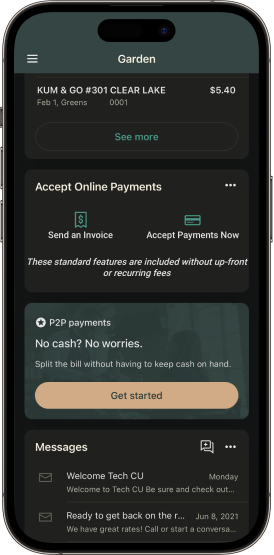

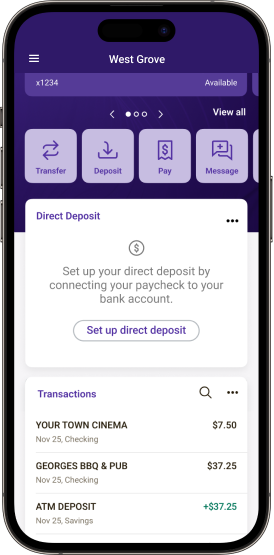

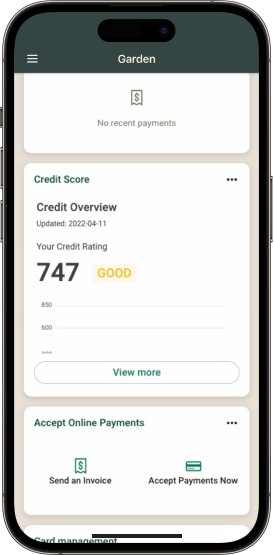

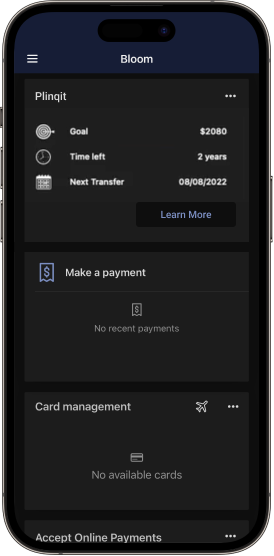

Opportunities are endless when you take roads less traveled. With open access to Jack Henry’s digital banking platform, your institution can choose leading fintech solutions and plug-and-play, making it easy to get creative on strategy and execution. Not to mention the ability to expand your brand using the same core with multibranding.

see what people are building

on our open platform

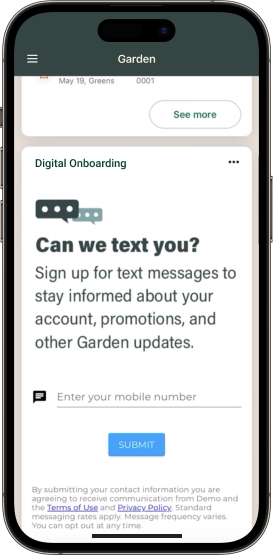

Fintechs and financial institutions are leveraging Jack Henry's self-service APIs and building embedded experiences that solve local needs. That's the power of our open platform – find a gap and build to fill it. See how these financial institutions have taken the initiative with fintechs and built an embedded experience using the Jack Henry Docs.

you can do it too with our self-service API

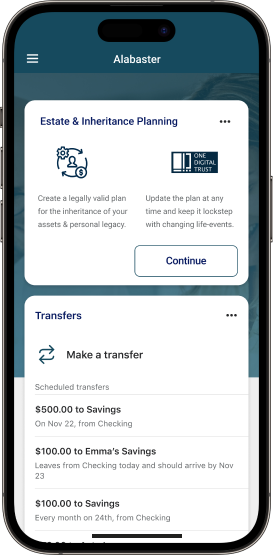

see what Jack Henry's partnerships do for the digital banking experience

Count on our team to strategize and build too. We've built partnerships with high-quality, big-name providers, and because you have us as your partner, you can access these kinds of services and deliver them to your accountholders. See who our developer team has built with using other third-party open-source code.

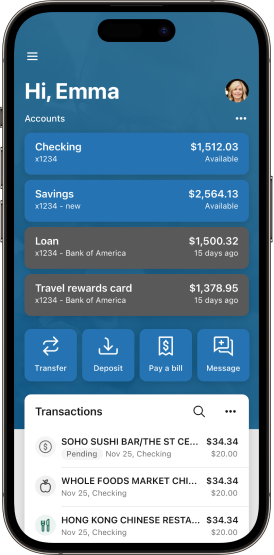

all financial accounts

now in one place

View internal and external accounts in one central location with linked account connection.

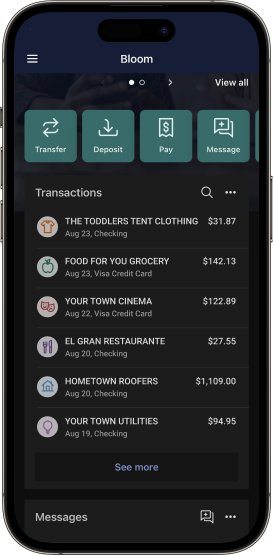

matching merchant and

transaction names

Match up merchant and transaction names for ease of readability and memorability.

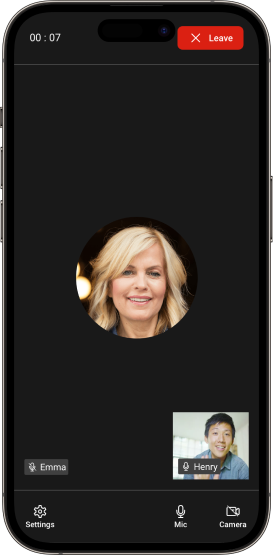

face-to-face

conversation

Video chat and screen sharing now brought into Banno Conversations for enhanced user support.

Why Jack Henry?

what sets Jack Henry apart from the competition?

We're not just opening up our technology, we're giving you the right platform to build and connect with who you wish as you wish, all under your own brand.

Our API is reliable

We're giving you access to the same API that Banno itself is built on – something no other banking platform is doing. Since our API is the backbone of our company, you can rest assured knowing that the technology that's powering your financial institution is our lifeline too. That means you can trust in its reliability and credibility 24/7 365.

Our documentation is publicly available

At Jack Henry, we're committed to helping others and we believe “what's ours is yours” when it comes to developer documentation. That means you can self-register and get your own API keys without any engagement with Jack Henry. It's the only self-service API in the banking industry.

With access to our documentation, we're equipping developers everywhere with the information they need to build – and these building efforts not only create better user experiences, but industry experiences too. We have everyone's best interest in mind as we move toward integration innovation.

Our strategy is unbundling the core

Integrating digital solutions works better with modern technology that matches digital standards. We've already begun unbundling the core, moving from locked-together functions to independent, cloud-based components that speak the same modern language as the fintech you're looking to integrate with. That means you no longer need to wait for an entire new core and can instead begin upgrading at a component-level. The worlds of digital and core are colliding as one digital core.

Case study

See how this bank used the Digital Toolkit to increase their mobile deposit volume by 59%

Alex Carriles

Chief Digital Officer & Executive VP, Simmons Bank

Alex Carriles

Chief Digital Officer & Executive VP, Simmons Bank

you can start building now

Tools are open and ready to fuel your innovation. And so are the resources you need to get going.

Start developing on your own

Our digital toolkit and developer documentation are designed to equip developers – whether you're a financial institution or a fintech. We've published all our developer documentation, so there's no need to wait on anyone.

This may be the best option if you and your team are looking to jump into a self-service environment and are ready to develop new integrations on your own.

Leverage already-existing integrations

A growing list of products already works with the Jack Henry platform. Others have gone and established engagements between our API and another, so this makes an easier connection for you to build on. Find and leverage options that could work for your financial institution.

This may be the best option if you're someone with an idea and a team to build it but looking for already-established connections.

Let us build for you

Where opportunity meets, “Okay, let's make this real.” Our Custom Development team knows their stuff – fintech and the Jack Henry platform – and they're ready to help. From brainstorming to launch, we're here to walk you through custom options.

This may be the best option if you're someone with an idea but looking for a team to make it a reality.

developer support & events

Attend an upcoming event to hear industry trends and expert insights, or join

our monthly digital toolkit meetup for help, advice, or plain old developer fun.

Start innovating today

Let's talk about what this could look like for your financial institution.