Conversations

The first-ever authenticated chat for digital banking

You’re there for accountholders in-branch. Imagine giving them the same service over the digital channel – literally.

Authenticated chat

Deliver a digital service experience on par with what they expect from visiting your branch

Go beyond what other chat tools can do with secure, authenticated chat, woven seamlessly throughout your digital banking experience. Conversations bridges the gap between the good ol’ days – where you knew your people on a personal level – and the digital world we live in now by helping you engage personally and contextually with users on the digital channel.

Beyond self-service

Digital banking has provided the ability to self-serve, but self-service has its limits. With Conversations, reaching the edge of self-service – the point at which users need assistance from you – no longer means a trip to the branch. Now someone from your branch can be pulled into the service stream as part of the banking app experience.

Native & secure

With Conversations, you can help people, via chat, in the context of their unique problems, at their moment of need. Core connection gives you full visibility of user account activity. And since you have full assurance that users are authenticated, you can even transact on their behalf. All of this adds up to faster problem resolution, and happier users.

Easy audits

Because Banno apps are core-connected, Conversations is totally auditable. Every single conversation is securely stored, so each dialogue can be audited both externally and internally. We know the auditing process can be stressful – this is just one less thing you have to worry about.

How it works

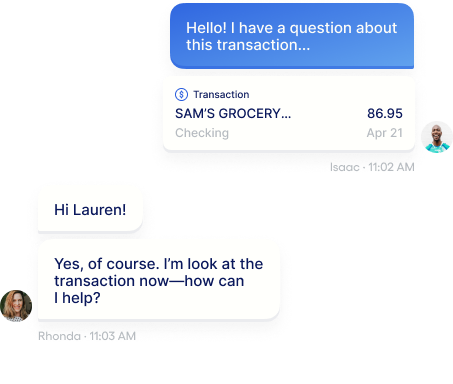

Support that’s woven throughout digital banking

Ditch the tools that act as a browser pop-up within your app or require users to re-enter simple details you should already know, like their name. A conversation in Banno can be contextually started from anywhere in the app, for both retail and business users.

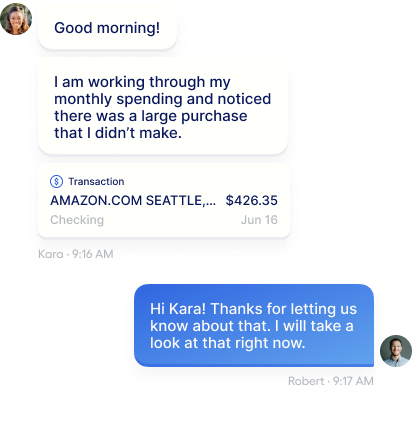

How it works for them

Imagine your customer or member see a questionable transaction on their account. They can simply open a conversation, and it will bring the transaction with them to a new chat thread.

How it works for you

The support representative at your branch will be able to interact with the attached transaction right inside Banno Support, instead of having to look it up in another system.

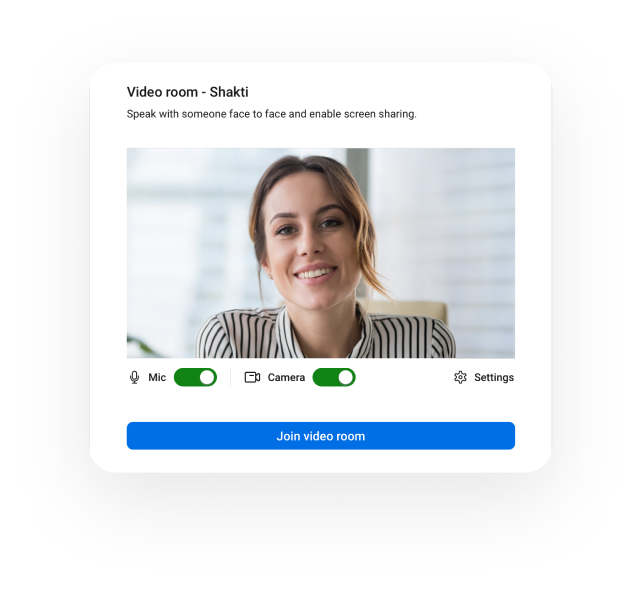

Video chat & screen sharing

connect with your people like the good ol’ days

Some conversations are best had face-to-face, there’s no way around it. And so you may be asking yourself, what can we do now that many people prefer to manage their banking on the digital channel? Whether for the sake of convenience, or in an effort to remain socially distant, users are finding themselves in your branch less and less often.

Fear not – with video chat and screen sharing functionality in Banno, you can have in-depth conversations and quickly resolve those more complicated accountholder issues without the need to be in-person.

Back-office experience

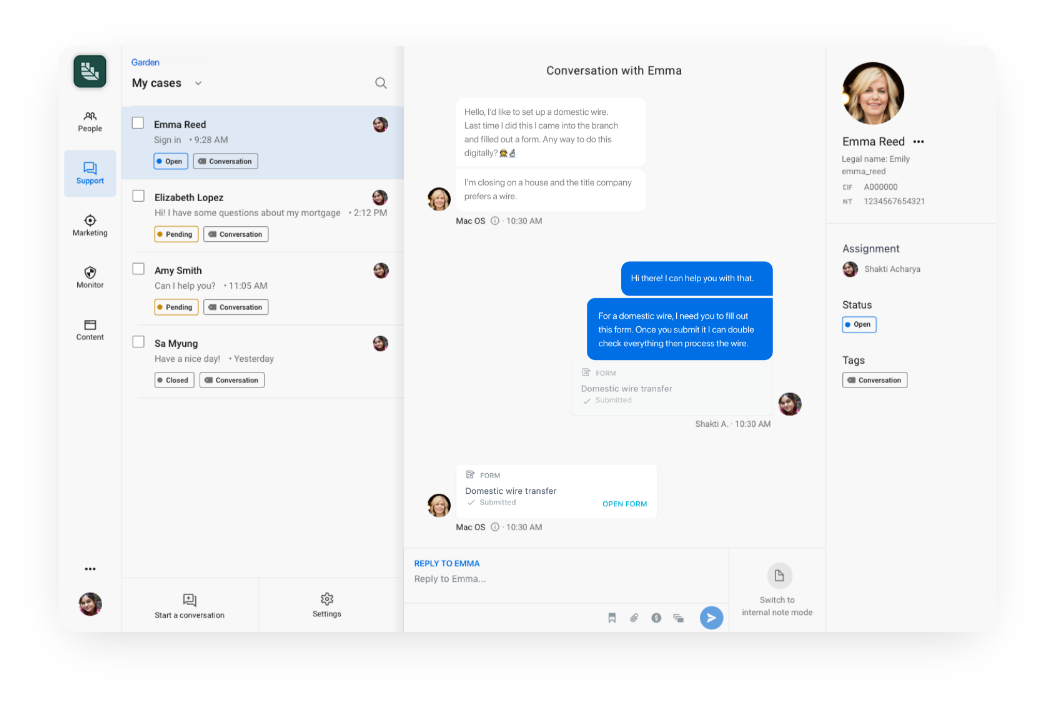

Managing multiple conversations is easy

Staying on top of incoming chat conversations was top-of-mind as we designed the financial institution’s side of the conversation. It all happens right within Support.

Tools for your team to collaborate

Clear conversation statuses and the ability to assign each conversation to a teller, customer support rep, or loan officer makes helping multiple people at once a breeze.

So when six conversations come in at once, employees can easily share the load and enter dialogues, confident about the conversation status and subject matter.

AI in Banno Conversations

power up your service

with AI

With the recent popularization of artificial intelligence (AI) – specifically Generative AI – Jack Henry began brainstorming how we could make things easier for financial institutions. We decided to start by easing the workflow of already-overwhelmed support representatives by giving them an assistant that helps quickly and accurately craft responses to your accountholders while keeping a human on the other side of the conversation.

This not only saves the time and effort of composing a message from scratch, but also ensures that the response aligns perfectly with the correct information and specific voice of your financial institution.

Attachments and forms

Catch everyone up to speed with attached context

When your transaction information and account details are not accessible in the same location as your communication channel, it takes precious time to look around and gather the important data – time that would be better spent finding a solution for your user’s problem. With Conversations, it’s simple for both users and employees to provide additional context through attachments.

Multiple attachment types

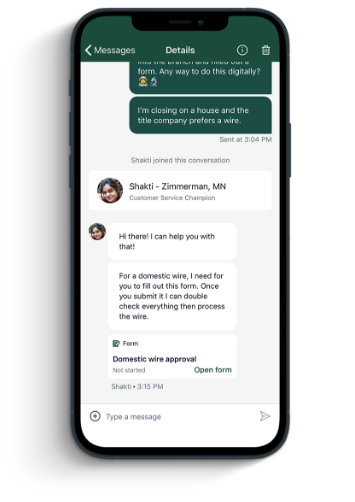

Files, transactions, accounts, payments, and even authenticated forms can be included with messages, without ever leaving the chat thread. This effectively reduces the time from your user’s moment of need to their point of resolution, and it simplifies the support workflow for employees – a win-win situation for all.

No-fuss forms

Whether it’s a wire request, an address change, or a loan application, most people will need to fill out a form from time to time. Forms are built right into Conversations, allowing for increased convenience and security. And since users are already authenticated, forms will auto-fill ancillary information so they can get straight to the point and submit the form in no time.

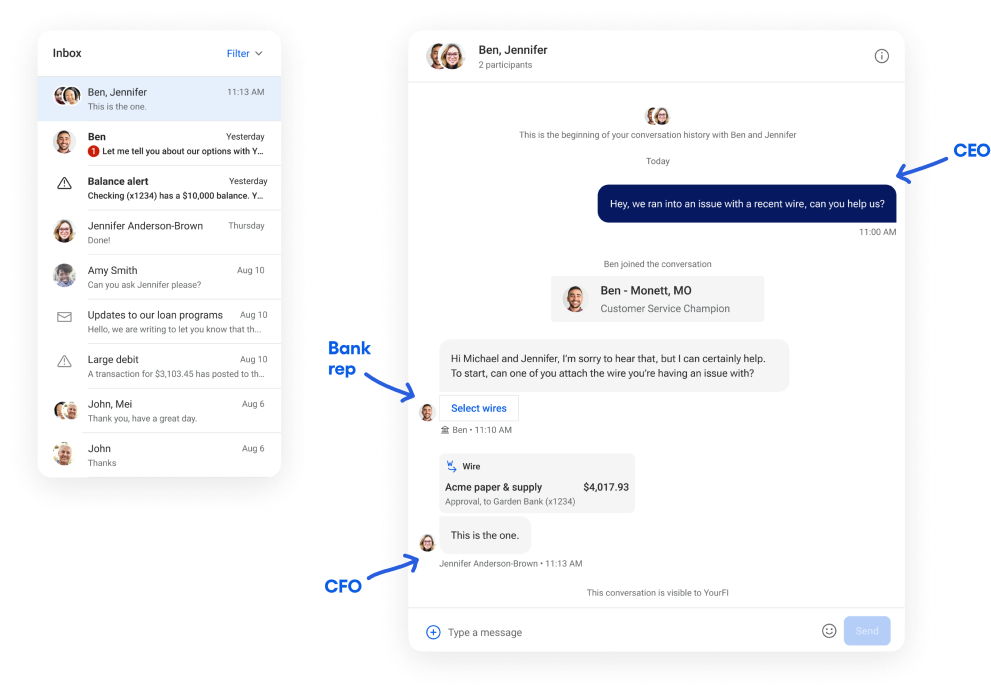

Conversations for Business

a secure way to do business

Email is not secure, and businesses lose hundreds of millions of dollars every month to email phishing fraud. Give your accountholders a better, more secure way to do business—right where their finances are based.

Conversations for Business is a brand new service you can offer your business users right within your digital banking experience. One place for them to discuss private information, attach sensitive files, and approve payments and wire transfers. They can even loop you into a conversation when they need clarification, review, or help making a transaction.

Heidi Kassab

CEO, Cornerstone Community Financial

Heidi Kassab

CEO, Cornerstone Community Financial

Extend human service outside your walls

Let's talk about what this could look like for your financial institution.