Digital Banking

The most personal

digital banking suite

Our platform continues to evolve in the pursuit of providing the best user experience possible. That's why we've elevated UX to be the top priority – not only for every feature but for every touchpoint our software has with another human.

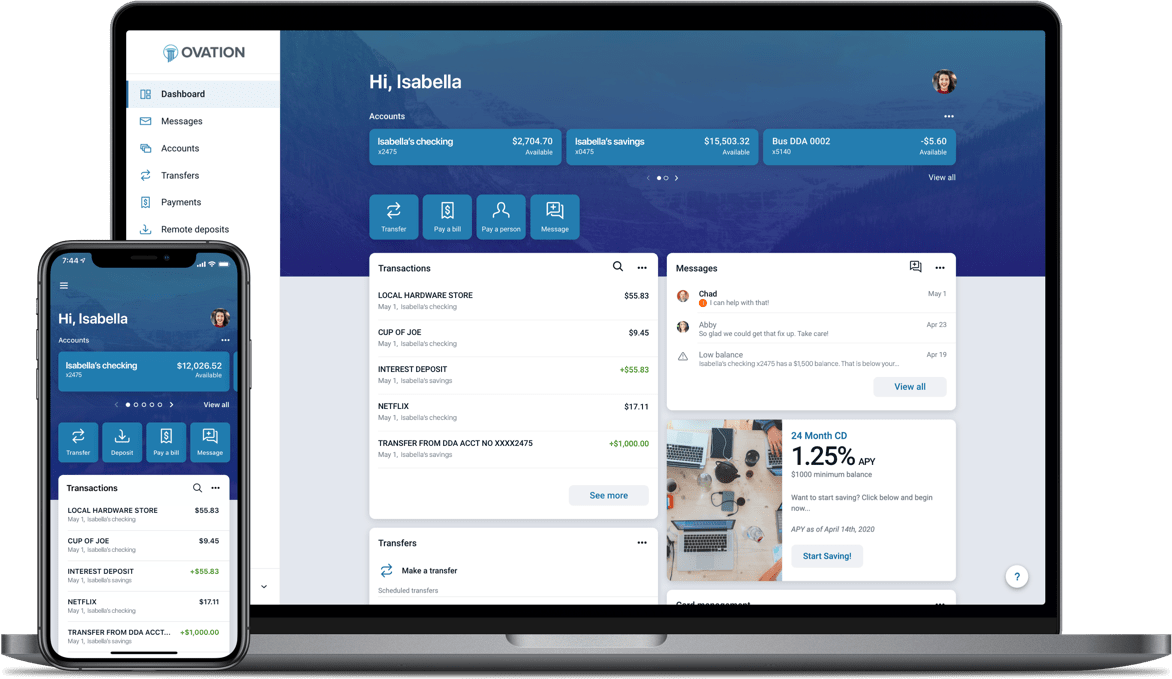

Mobile and Online Experience

A seamless, fast, and forward-thinking experience

Banno works across users' devices and is developed with industry-leading technology to deliver a smooth experience your users are used to (think Instagram).

A unified digital solution meets the human touch

In the race to make all things digital, financial institutions have pieced together solutions that don't always work in harmony. We're working to transform your digital banking experience – leveraging the humanness and trust that sets you apart from the rest.

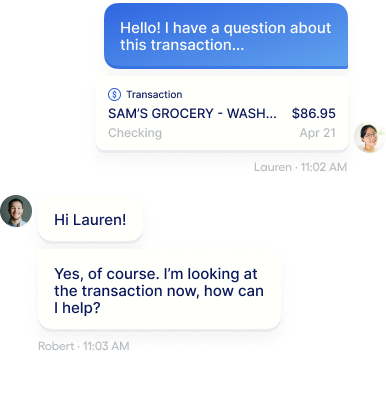

Conversations

Provide a service that no other digital banking solution can

You're there for accountholders in-branch. Imagine giving them the same service, provided by the same tellers, over the digital channel – at the moment of need.

powered by

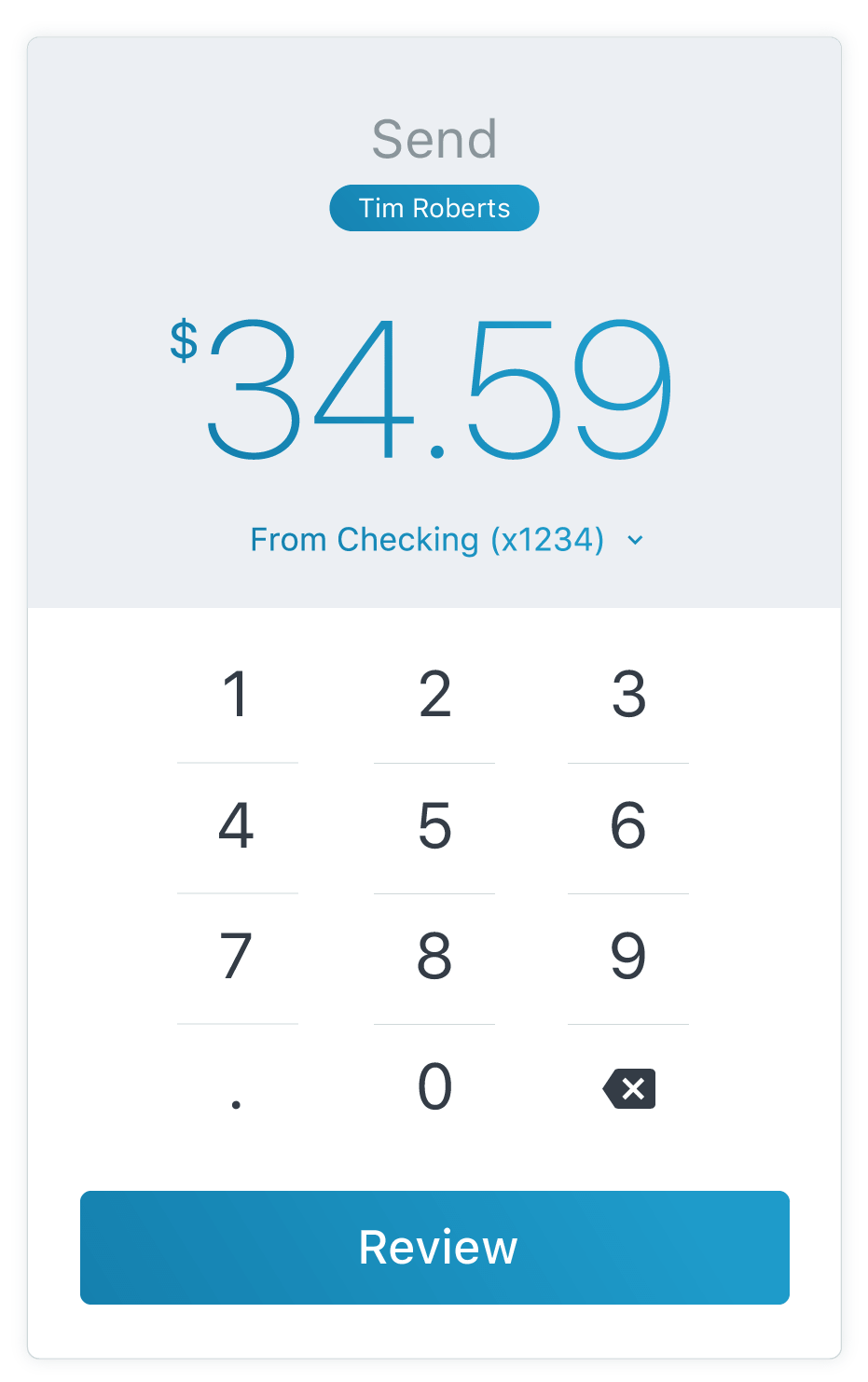

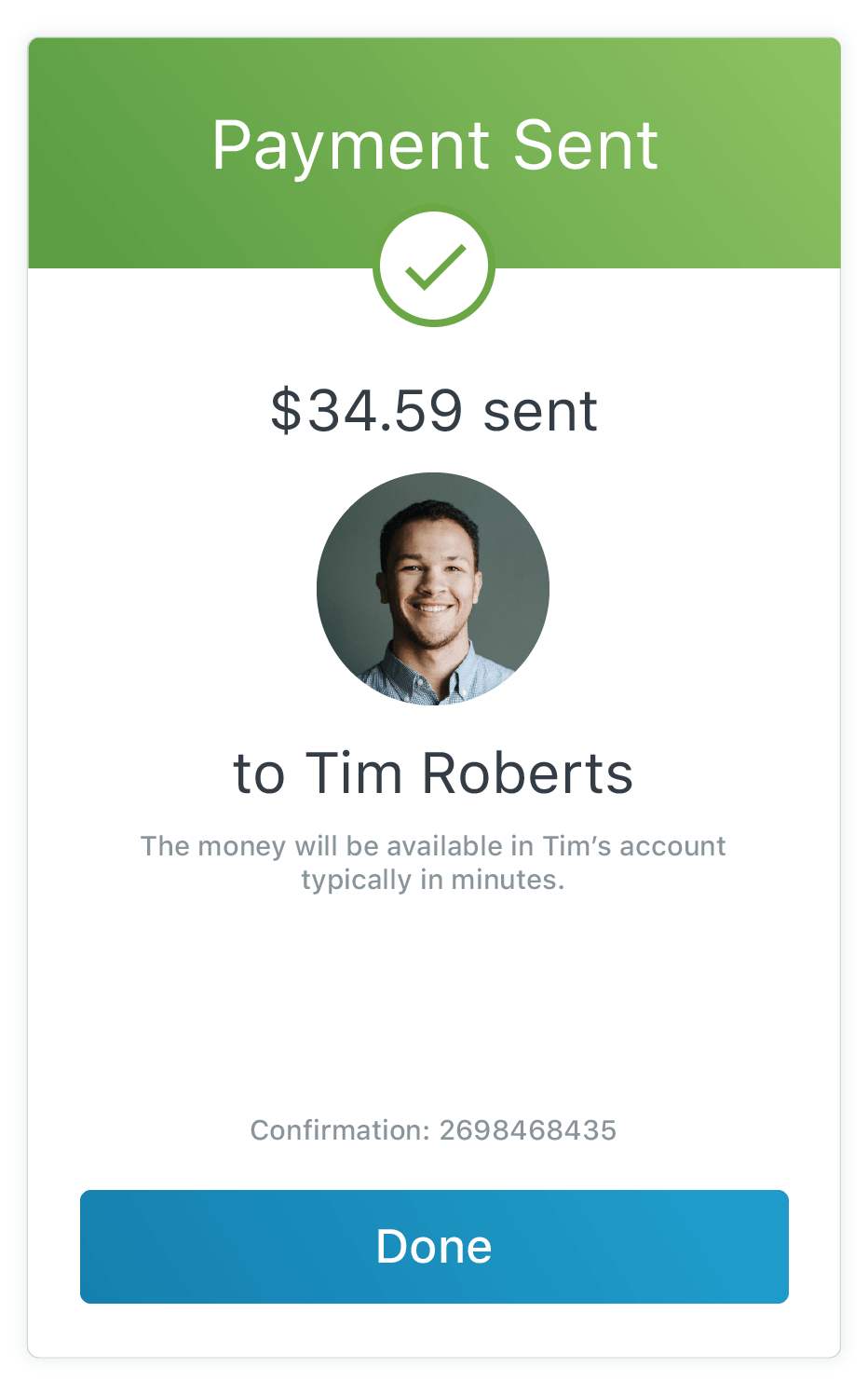

Payments

Now you’re paying with the big dogs

Make it easier than ever for your users to make payments through your app. Between iPay, Jack Henry’s convenient payment solution, and on-the-spot, peer-to-peer payment through Zelle®, the big banks have nothing on you.

Card Management

Pick a card, any card

Give your users autonomy over fraud protection by allowing them advanced control over their cards. Switching cards on and off comes standard with Banno, and paired with JHA MyCardRules, users can block transactions made out-of-country, be notified about certain purchase types, and block transactions at restaurants or gas stations or an array of other vendor types. They can even set a custom spending limit of $500 (or $5,000). And where they receive those notifications is completely up to them.

Alerts

Tell them what they want to know

Build trust with your customers and members by keeping them informed of the things they care about most. Allow them to set up alerts for high or low balances or transaction amounts. They designate the thresholds, and they choose the alert delivery method.

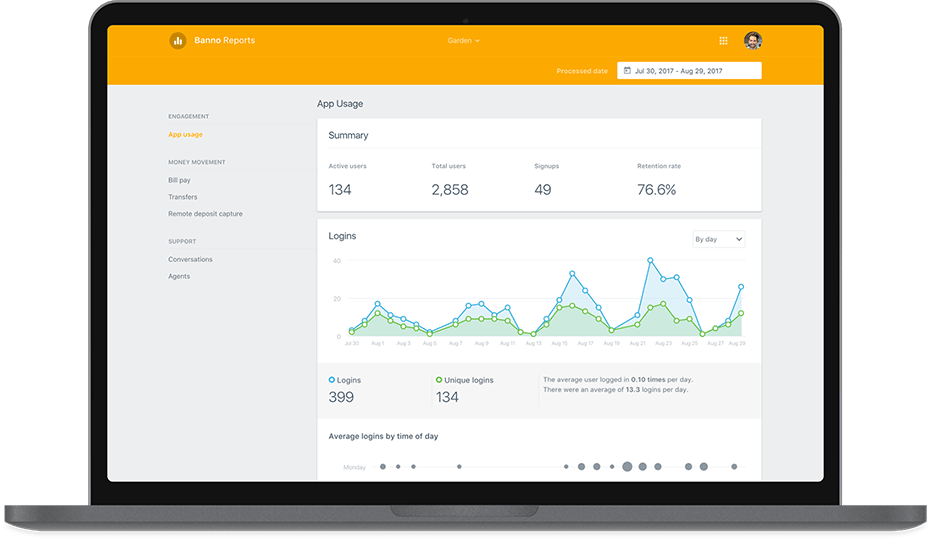

Reports

Keep a pulse on your users

With Reports, you can understand trends to make better decisions. Learn how your users are using your app, get details about bill pay, track how much money is moved through transfers and gain insights about your users’ remote deposits, enrollments and more.

Authentication

Security that saves time

We offer the latest in secure authentication solutions. Users can enroll themselves in two-factor authentication and take advantage of biometric or 4-digit passcode access, and self-service account recovery makes it easy for them to recover forgotten passwords. Plus, they can switch between accounts easily on mobile.

Banking Basics

Everyone does it – we do it well

Your customers and members expect the ability to accomplish simple banking tasks like managing accounts and transactions. They’re used to smooth app experiences like Instagram and Uber. What’s new to them is a banking app that delivers both.

Accounts

Users can open new accounts, view their balances, statements, documents and notices all in one place. If a user has multiple accounts, they can set account nicknames to keep them straight, and they can customize their accounts dashboard to display which accounts they want to view and in what order.

Transactions

Transaction lists become interactive with the ability to tag, add notes, and attach images of receipts. And navigating transactions is simple with search capability paired with the friendly, fluid, infinite scroll that comes with native and progressive web apps.

More Features

Locations/ATMs

Some conversations are easier in person. Make it easy for your users to find your branch and ATM locations – right within your app.

Remote Deposits

Depositing checks is a snap. Check deposits can happen anywhere, anytime with built-in remote deposit capture.

Business Banking

Attract and retain business accountholders with easy-to-access business banking functionality, like Banno’s Cash Management SSO.

Switch to a better platform

Let's talk about what this could look like for your financial institution.